Utilize machine learning to continuously monitor transaction data, identify anomalous customer behavior, and prevent money laundering with Effectiv’s AML transaction monitoring solution.

Utilize world-class data services & machine learning to continuously monitor transaction data to analyze customer behavioral patterns and identify money laundering schemes.

Our Transaction Monitoring Solution will send your team suspicious activity alerts in real-time based on transaction and account data across the customer lifecycle.

Harness a vast network of data signals - identity, transactions, behaviors, and more - delivering a complete historical view of the customer’s behavior. This allows you to proactively identify and stop money laundering, fraud, and other financial crimes that others miss.

Streamline the entire investigation process from alert triage and risk scoring to evidence gathering, decisioning, and filing SAR/CTR reports directly to FinCEN using our genAI report narrative writing assistant.

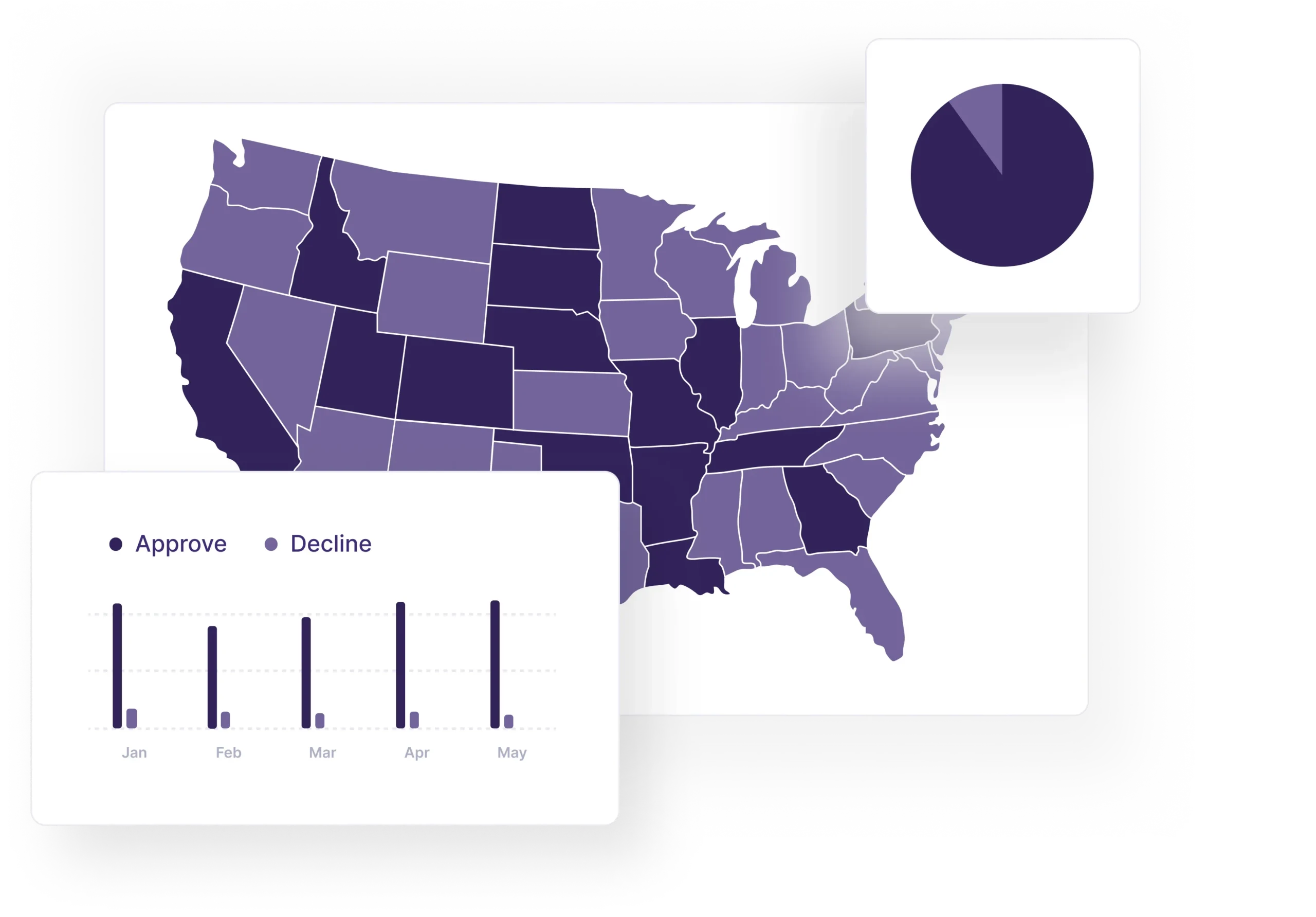

Effectiv identifies sophisticated criminal activity by analyzing entity relationships across devices, identities, transactions, and data points - catching money mules, laundering rings, and fraud within complex information webs. Use our out-of-the-box machine learning models or train your own model using customer data to pinpoint anomalies and generate alerts in real time.

Combine graph data, machine learning, and external data sources using custom rules and decision flows to continuously asses account holder risk.

Create custom rules that define suspicious activity specific to your business's context to enhance the precision and effectiveness of fraud detection.

Simulate and evaluate the effectiveness of different fraud detection rules before implementing them to minimize false positives and fine-tune your risk parameters.

Detect, prevent, and report money laundering activities. We continuously scan and analyze transaction patterns, allowing you to remain compliant with AML regulations.

Create tailored lists to approve trusted entities (Allow List) or block suspicious ones (Deny List), enhancing your control over transactions.

Apply preset detection rules to transactions as they occur, enabling instant identification and prevention of suspicious activities to ensure optimal protection.

<span data-metadata=""><span data-buffer="">By mapping out the complex relationships between entities and transactions, our network graph will reveal hidden patterns, connections, and suspicious behavior.

"After considering other solution providers such as Alloy and Persona we chose Effectiv because of their superior AML transaction monitoring solution. The platform's flexibility, quick integration and AML monitoring capabilities were key factors that set Effectiv apart from the rest."

Alora Calcagno

Vice President, Operations

“The platform’s ability to adapt to new threat vectors without extensive re-coding, combined with their partnerships with multiple validation vendors, provides us with the agility and coverage we need to protect our clients effectively.”

Director of Compliance

"The transition from our previous solution to Effectiv has substantially enhanced my team's ability to make data-driven risk decisions and streamline our fraud detection process. The flexible nature of Effectiv's platform has allowed us to meet the evolving needs of our members and better manage risk across our organization."

VP, Audit & Risk

“We think of Effectiv like Android. You can go with their pre-built solution enabling one of the fastest go-to-market risk solutions to meet your customers where they are at or add your customization in a layered approach to enable seamless customer experiences.”

SVP, Financial Management

"The most exciting aspect for our team is related to our risk, credit, and fraud policies and that we are able to do a lot by ourselves without involving our engineering team as a result of partnering with Effectiv."

Director of Risk

"You want to make sure that your KYB solution can validate any business's legitimacy quickly and accurately. Effectiv’s sub-300ms response time for business & UBO checks is best-in-class for any operator in our space."

SVP, Operations

AML transaction monitoring is an automated process used by financial institutions to analyze customer transactions in real-time or on a scheduled basis to detect and report suspicious activities indicative of money laundering. This process involves scrutinizing patterns of behavior that deviate from the norm, with the aim of preventing financial crimes and ensuring regulatory compliance.

An AML screening tool is a software solution, used by financial institutions to automatically check clients and transactions against regulatory watchlists, sanctions lists, and databases of politically exposed persons (PEPs) to identify and mitigate risks associated with money laundering and terrorist financing. This tool plays a crucial role in ensuring compliance with global anti-money laundering regulations.

Customer Due Diligence (CDD) and Enhanced Due Diligence (EDD) are anti-money laundering (AML) processes used by financial institutions to assess the risk level of customers and understand their financial activities. CDD is the standard process for all customers, while EDD is an additional, more detailed process applied to higher-risk customers or transactions, requiring more extensive information gathering and analysis.

Stop payment fraud at the point of transaction across multiple channels including cards, ACH, Zelle, RTP, and FedNow.

Onboard customers faster with fully customizable KYC, CIP, and EDD process automation. Our step-up risk workflow editor is designed to help you reduce customer friction and manage costs.

Verify good businesses faster with streamlined business application + UBO checks leveraging the best KYB data sources and AI/ML enabled checks.

Effectiv is a real-time fraud & risk decisioning platform for FIs & Fintechs. Enable AI-driven solutions for onboarding, transaction monitoring, underwriting, authentication events, and more.

© 2024 Abra Innovations, Inc | All rights reserved | Privacy Policy | Terms of Use