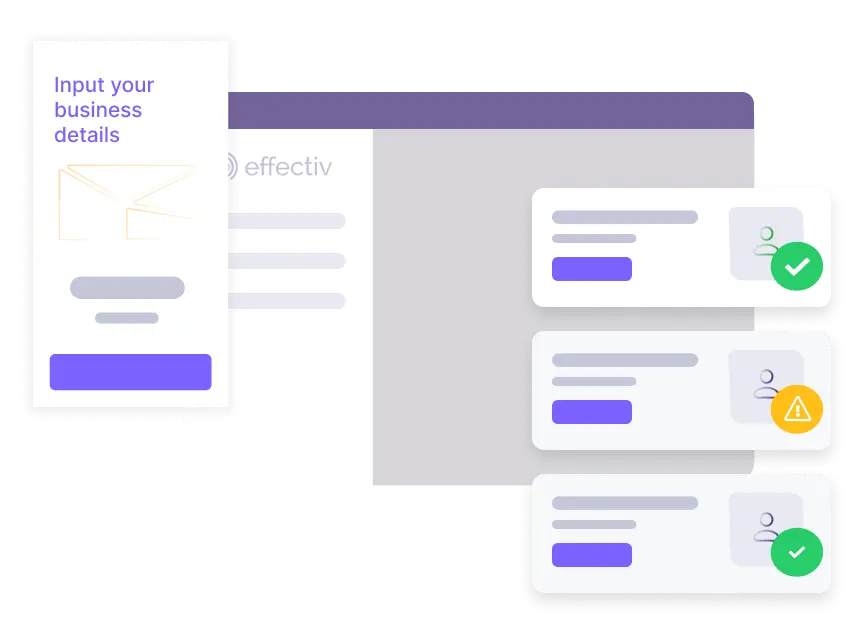

Stay AML compliant, automatically verify good businesses and alert your review team of potential fraud with our fully-integrated KYB (Know-Your-Business) business onboarding solution.

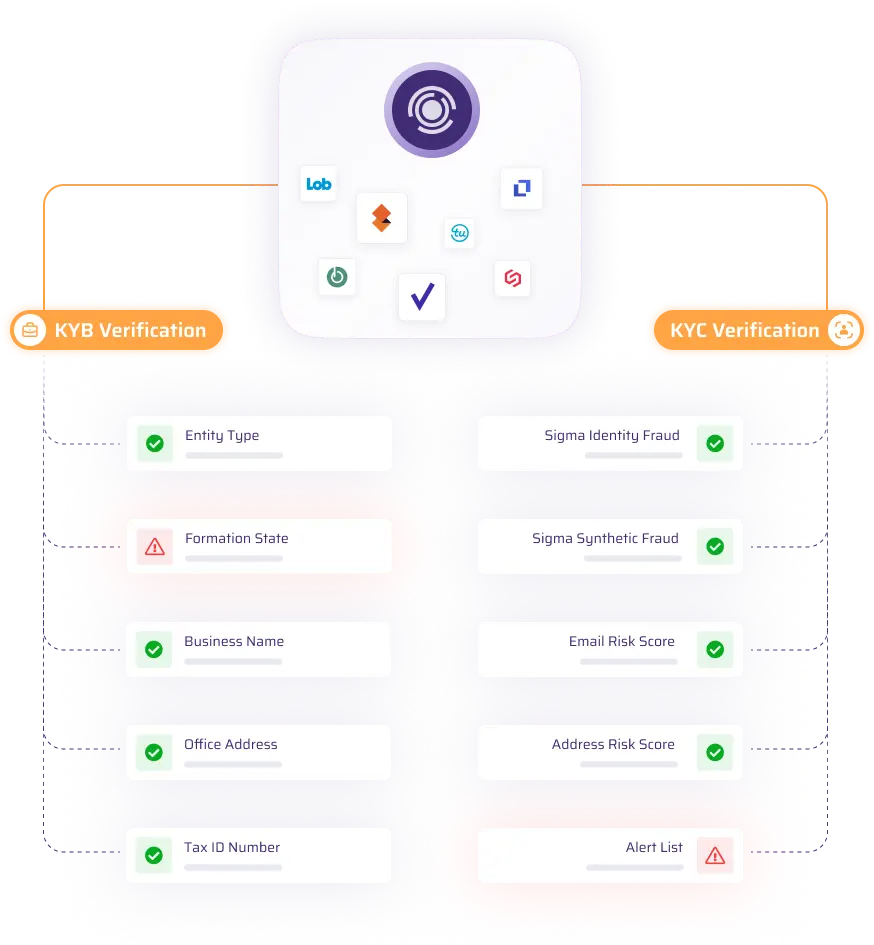

With automated UBO (ultimate business owner) verification and adverse media checks, financial service companies can effectively combat fraudulent businesses entering their ecosystem, eliminating manual verification while maintaining accuracy to reduce fraud loss.

Gain access to data from over 300 global corporate registries in 100+ countries, providing you with a vast repository of accurate and up-to-date company information. Verify customers by instantly accessing global primary source company data, limiting the need for manual searches and ensuring reliable results.

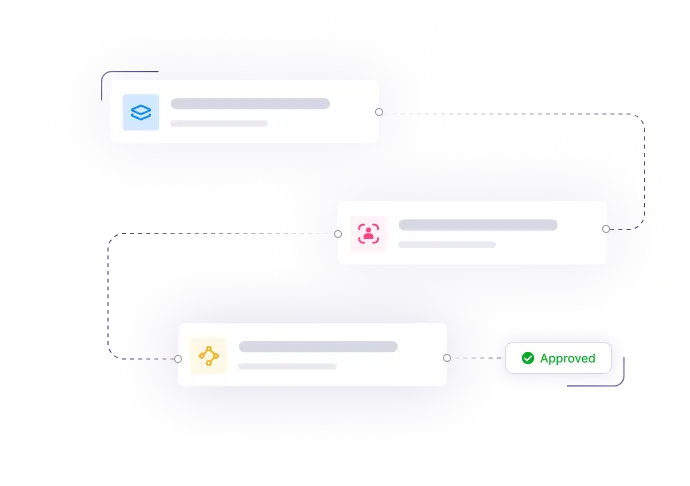

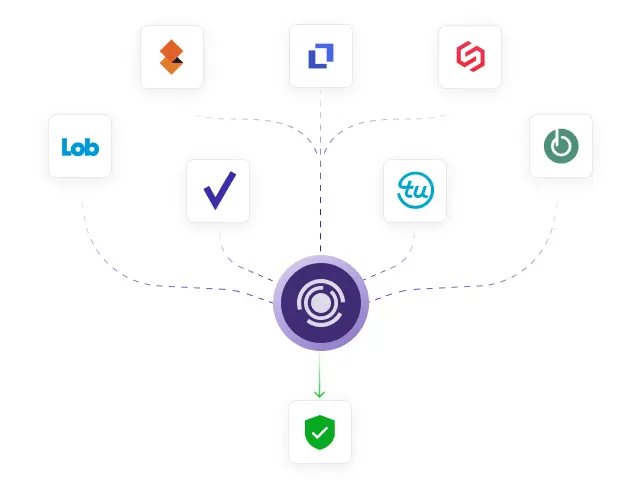

Consolidate all your checks and verifications into one workflow to streamline new business onboarding and save your fraud and compliance team precious time. Instantly reduce false positives and improve your review process over time by making rule changes when you want utilizing our drag-and-drop workflow strategy builder.

Effortlessly combine your Know Your Business (KYB) and Know Your Customer (KYC) processes into a seamless flow. Automate the retrieval and management of important documents, ensuring a centralized repository for efficient due diligence and data governance to experience accelerated onboarding while saving valuable time and resources.

Customize the capabilities of your business onboarding workflow depending on your industry, use case, size and budget. You can always add new capabilities as you consolidate systems and scale.

Verify the identity and information of new business applicants in seconds by cross-referencing data with 30+ data sources, flagging fraudulent applications, and automatically approving good businesses.

Analyze patterns and behaviors that flag fraudulent applications by continuously adapting to evolving fraud strategies. Our artificial intelligence enhances the accuracy of detecting threats and reducing false positives.

Verify that all business applications meet financial regulations such as AML, KYC, KYB, and CTF. Automating these checks streamline the onboarding process, eliminating your risk of non-compliance and related penalties.

Ensure ongoing regulatory compliance and due diligence by screening business customers against watchlists and flagging suspicious activities or changes post-onboarding.

Our flexible workflow builder makes it easy for your team to set up, adjust, and monitor rules and checks, giving you full control over your new business verification process.

Test new onboarding strategies using historical data to measure and compare their performance before you go live. Constantly refine your onboarding process, enhancing its ability to flag fraudulent applications and reduce false positives.

Effectiv is a real-time fraud & risk decisioning platform for FIs & Fintechs. Enable AI-driven solutions for onboarding, transaction monitoring, underwriting, authentication events, and more.

© 2024 Abra Innovations, Inc | All rights reserved | Privacy Policy | Terms of Use