Combine traditional credit scores with alternative underwriting data to automate credit risk decisions and make dynamic lending decisions in real-time to grow your portfolio with confidence.

Deliver a seamless customer experience by instantly analyzing and approving worthy credit applications leveraging machine learning models and AI. For any applications sent to manual review, we have you covered with a robust case management system and thoughtful automation to supercharge your team's operating cadence.

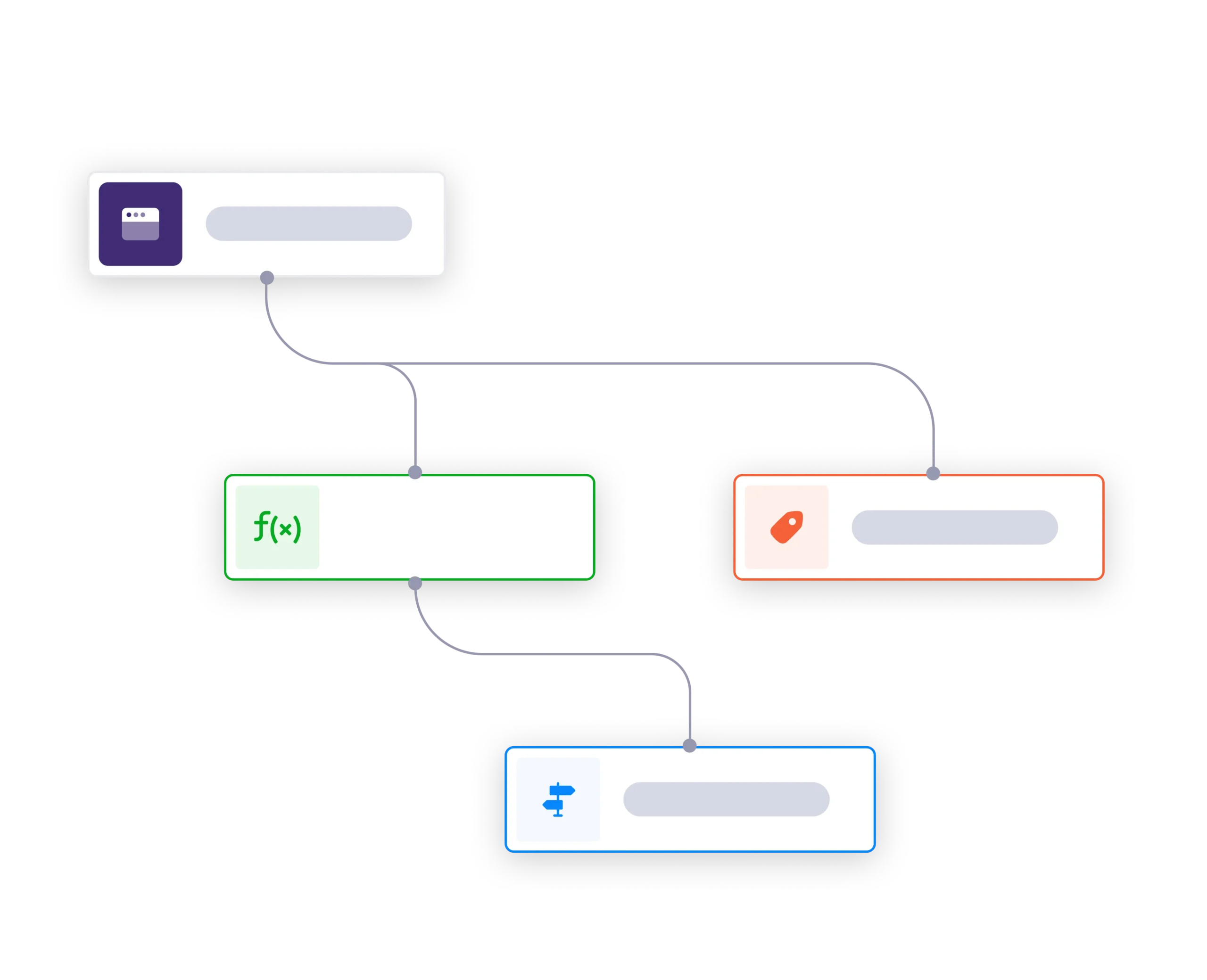

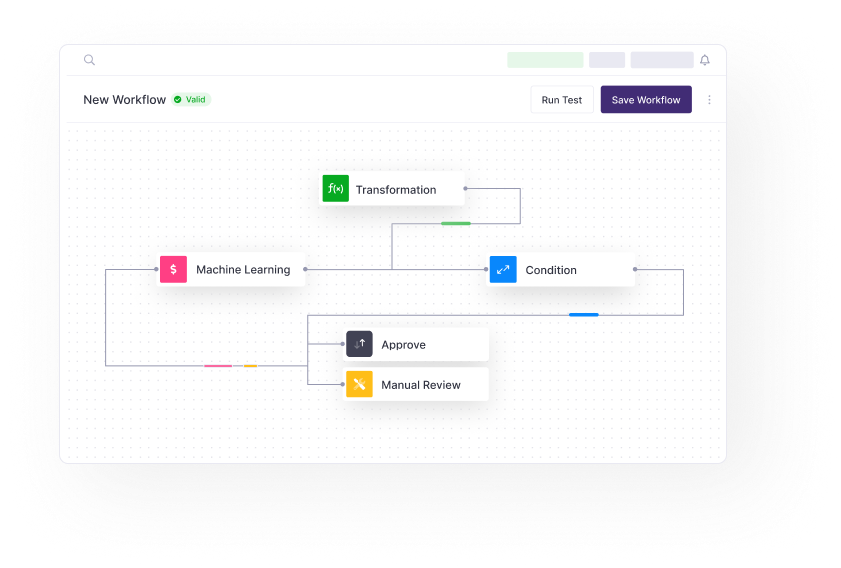

Our no-code workflow builder allows you to translate existing credit policies into workflows, creating anything from simple underwriting rules to intricate matrix models. As your policies evolve over time, you can test changes on live workflows or backtest using historical data.

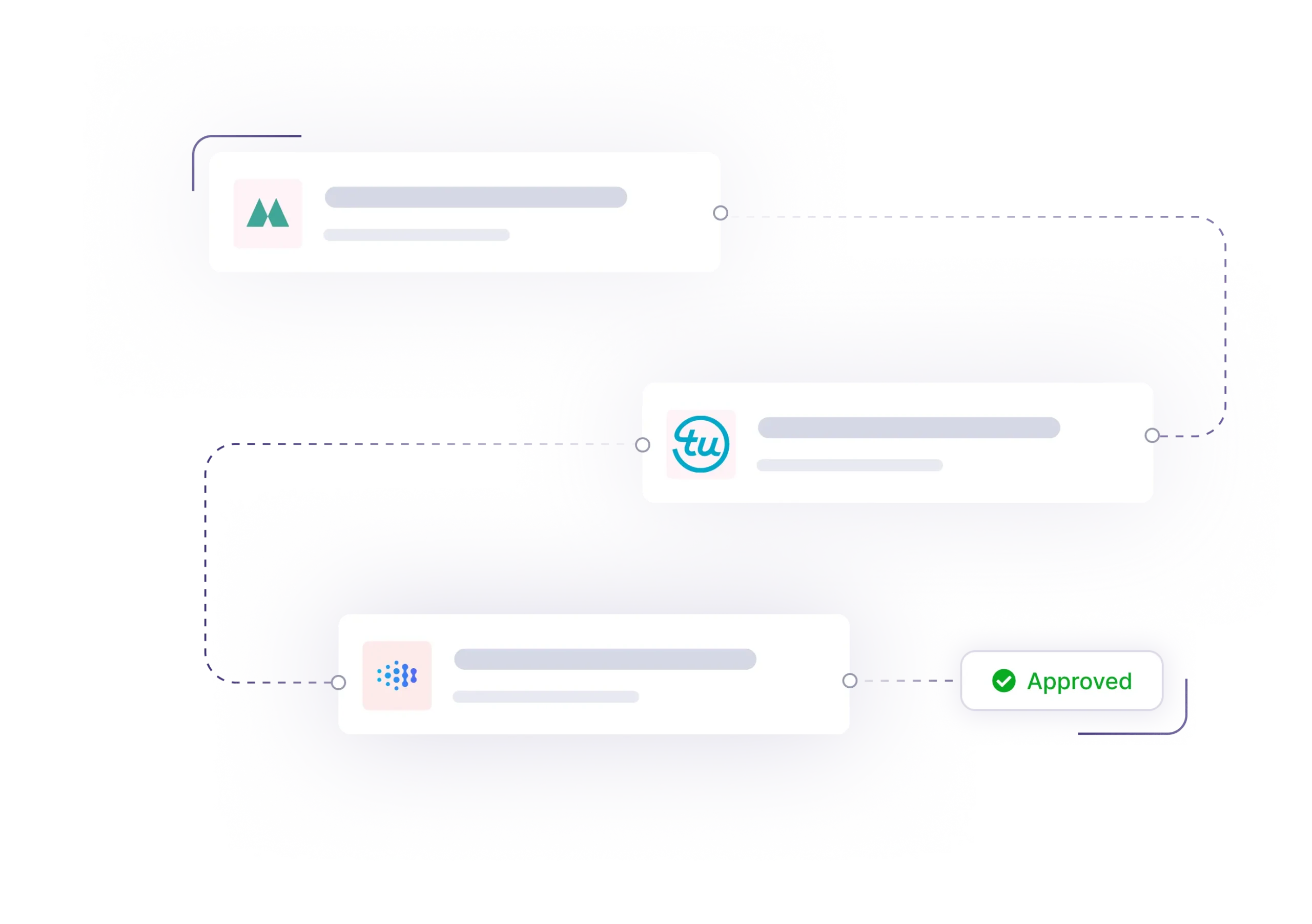

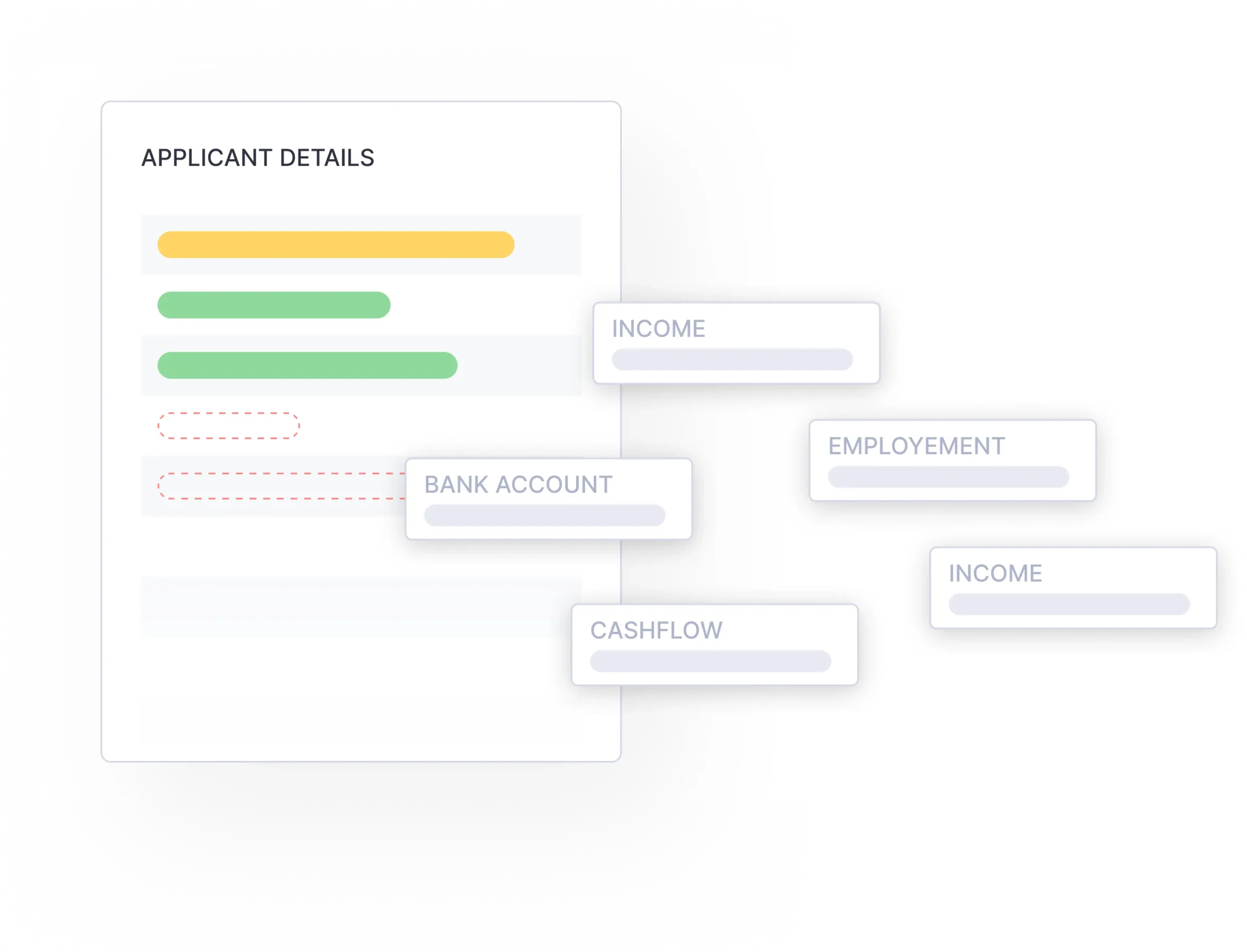

Start with traditional bureau data and apply multiple alternative underwriting data points such as employment and income, bank account information, cashflow data, and more to approve more applications without taking on additional risk.

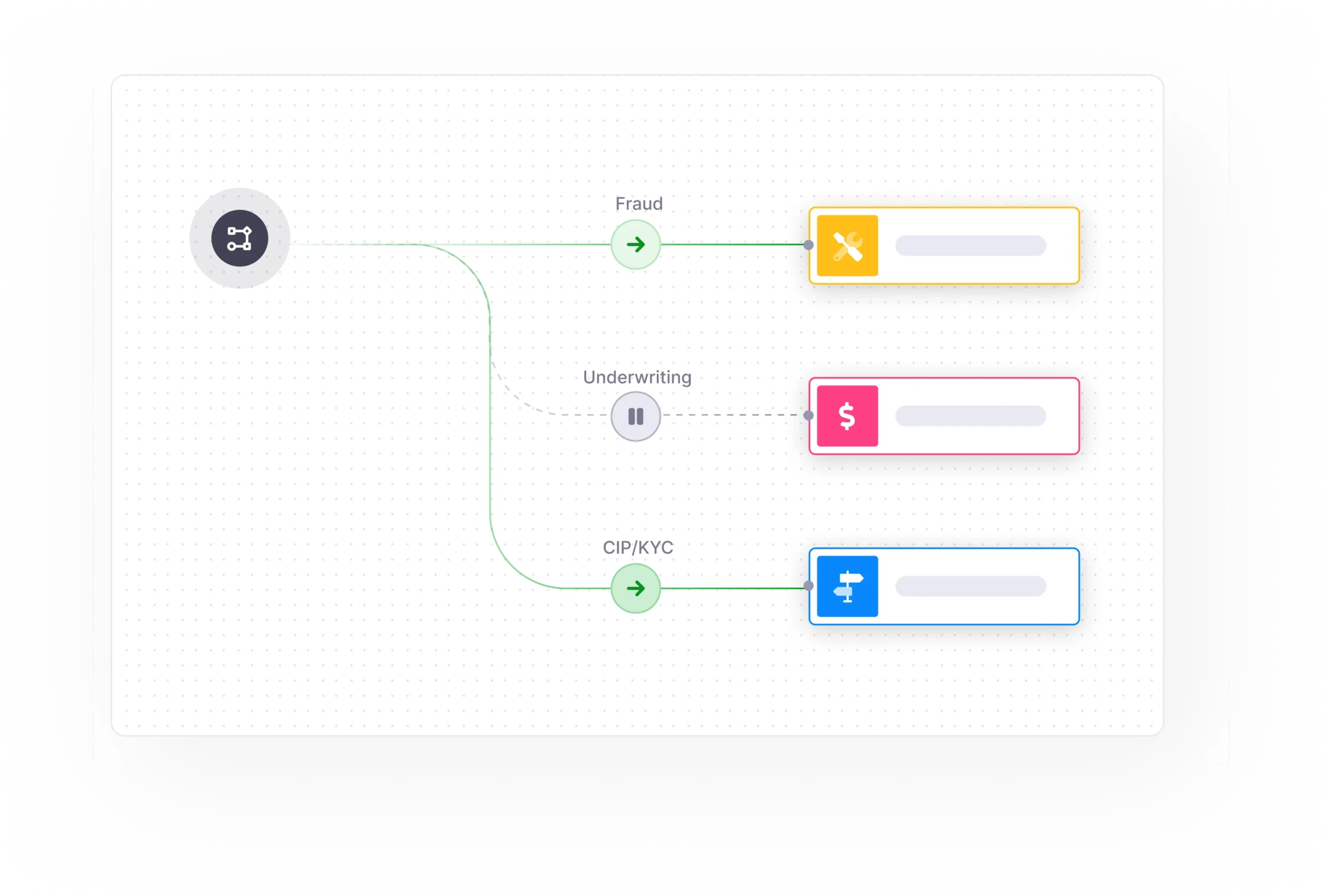

Running fraud, KYC/KYB, and credit checks in simultaneously speeds up approvals while allowing these processes to inform and enhance each other. This integrated approach improves decision accuracy, security, and compliance, delivering faster and more reliable outcomes.

"After considering other solution providers such as Alloy and Persona we chose Effectiv because of their superior AML transaction monitoring solution. The platform's flexibility, quick integration and AML monitoring capabilities were key factors that set Effectiv apart from the rest."

Alora Calcagno

Vice President, Operations

“The platform’s ability to adapt to new threat vectors without extensive re-coding, combined with their partnerships with multiple validation vendors, provides us with the agility and coverage we need to protect our clients effectively.”

Director of Compliance

"The transition from our previous solution to Effectiv has substantially enhanced my team's ability to make data-driven risk decisions and streamline our fraud detection process. The flexible nature of Effectiv's platform has allowed us to meet the evolving needs of our members and better manage risk across our organization."

VP, Audit & Risk

“We think of Effectiv like Android. You can go with their pre-built solution enabling one of the fastest go-to-market risk solutions to meet your customers where they are at or add your customization in a layered approach to enable seamless customer experiences.”

SVP, Financial Management

"The most exciting aspect for our team is related to our risk, credit, and fraud policies and that we are able to do a lot by ourselves without involving our engineering team as a result of partnering with Effectiv."

Director of Risk

"You want to make sure that your KYB solution can validate any business's legitimacy quickly and accurately. Effectiv’s sub-300ms response time for business & UBO checks is best-in-class for any operator in our space."

SVP, Operations

Effectiv's AI ensures compliance in underwriting decisions by automating adherence to regulatory frameworks and internal policies through pre-configured rules and continuous monitoring. The AI reviews every decision against up-to-date compliance guidelines, flags potential issues for review, and generates audit trails for transparency, helping financial institutions and fintechs stay compliant while streamlining the underwriting process.

Yes, Effectiv’s system can be tailored to your specific risk models. It allows you to customize risk assessment criteria, configure decision rules, and adapt AI-driven models to align with your unique business needs. This flexibility ensures that your underwriting decisions are consistent with your institution's risk tolerance and strategy while maximizing efficiency and accuracy.

Effectiv’s automated credit underwriting solution can be implemented quickly, with typical deployments taking just a few weeks. Our platform integrates seamlessly with your existing systems, and our dedicated onboarding team ensures a smooth setup, so you can start benefiting from faster, more accurate underwriting.

Onboard customers faster with fully customizable KYC, CIP, and EDD process automation. Our step-up risk workflow editor is designed to help you reduce customer friction and manage costs.

Verify good businesses faster with streamlined business application + UBO checks leveraging the best KYB data sources and AI/ML enabled checks.

Stop payment fraud at the point of transaction across multiple channels including cards, ACH, Zelle, RTP, and FedNow.

Effectiv is a real-time fraud & risk decisioning platform for FIs & Fintechs. Enable AI-driven solutions for onboarding, transaction monitoring, underwriting, authentication events, and more.

© 2024 Abra Innovations, Inc | All rights reserved | Privacy Policy | Terms of Use