Learn more about the market’s first unified identity, fraud, and risk decision engine.

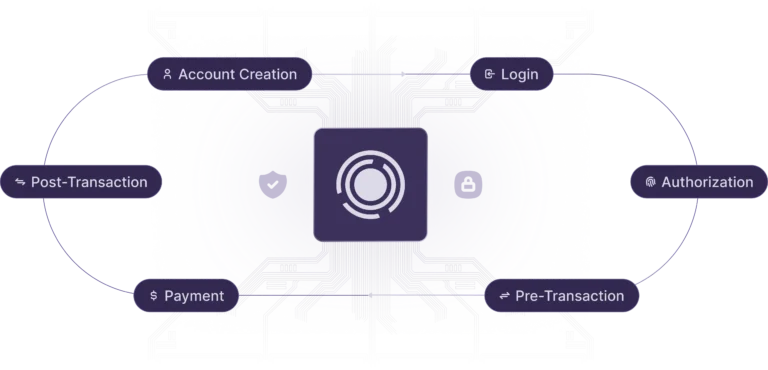

Effectiv transforms how you manage risk – moving from reactive to proactive protection across the entire customer journey leveraging advanced AI and machine learning models.

Reduction in manual reviews, and time to update fraud strategies.

Worth of automated risk and fraud decisions processed.

Reduced cost to manage fraud and risk with single platform integration.

By minimizing false positives with AI-powered risk strategies, your team can focus on real threats while delivering a seamless customer experience.

“The platform’s ability to adapt to new threat vectors without extensive re-coding, combined with their partnerships with multiple validation vendors, provides us with the agility and coverage we need to protect our clients effectively.”

Director of Compliance

"The transition from our previous solution to Effectiv has substantially enhanced my team's ability to make data-driven risk decisions and streamline our fraud detection process. The flexible nature of Effectiv's platform has allowed us to meet the evolving needs of our members and better manage risk across our organization."

VP, Audit & Risk

“We think of Effectiv like Android. You can go with their pre-built solution enabling one of the fastest go-to-market risk solutions to meet your customers where they are at or add your customization in a layered approach to enable seamless customer experiences.”

SVP, Financial Management

"The most exciting aspect for our team is related to our risk, credit, and fraud policies and that we are able to do a lot by ourselves without involving our engineering team as a result of partnering with Effectiv."

Director of Risk

"You want to make sure that your KYB solution can validate any business's legitimacy quickly and accurately. Effectiv’s sub-300ms response time for business & UBO checks is best-in-class for any operator in our space."

SVP, Operations

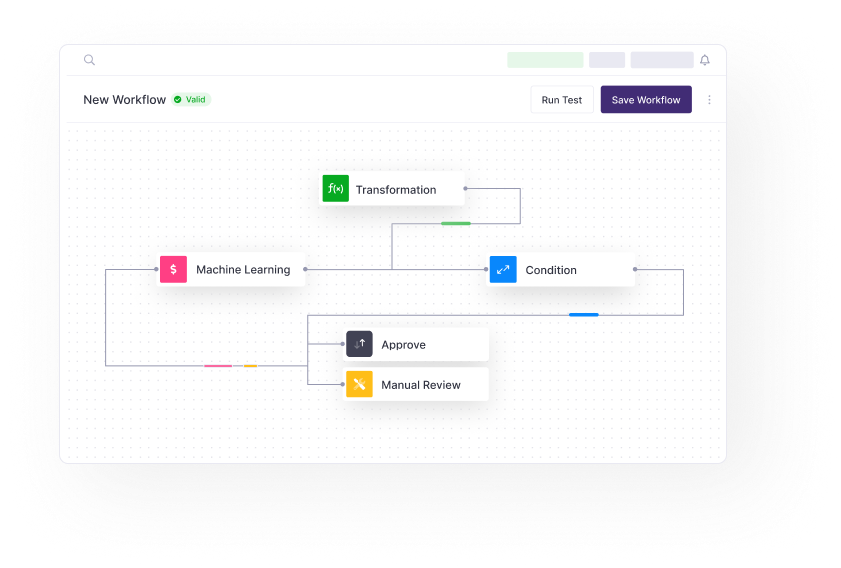

Effectiv’s AI-powered no-code platform enables your risk team to be in control of all fraud & compliance strategies through automated workflows.

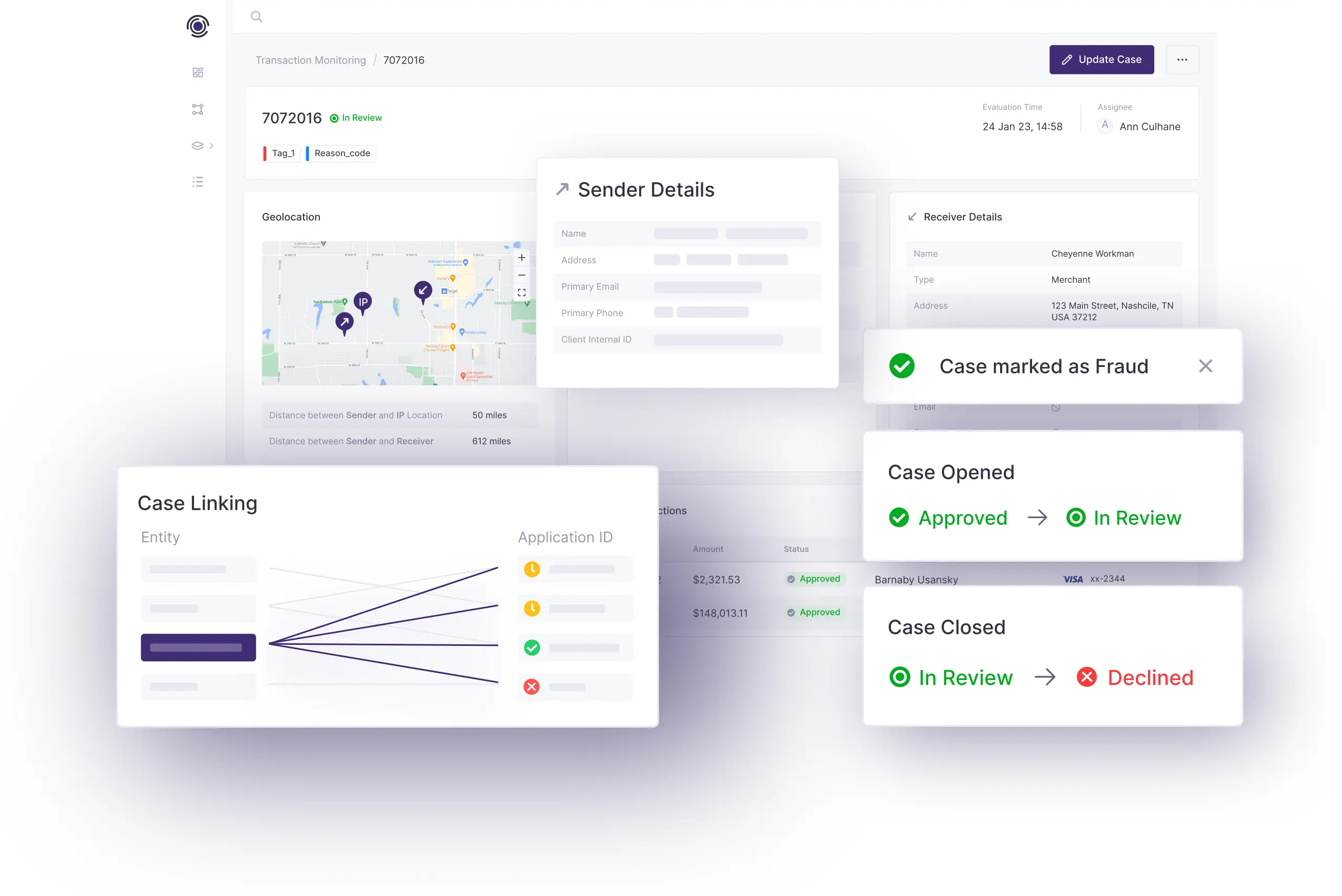

Visualize threats and monitor bad actors from a fully-customizable case management solution. Quickly investigate suspicious activities, gain critical insight into fraud rings, and proactively identify emerging threats.

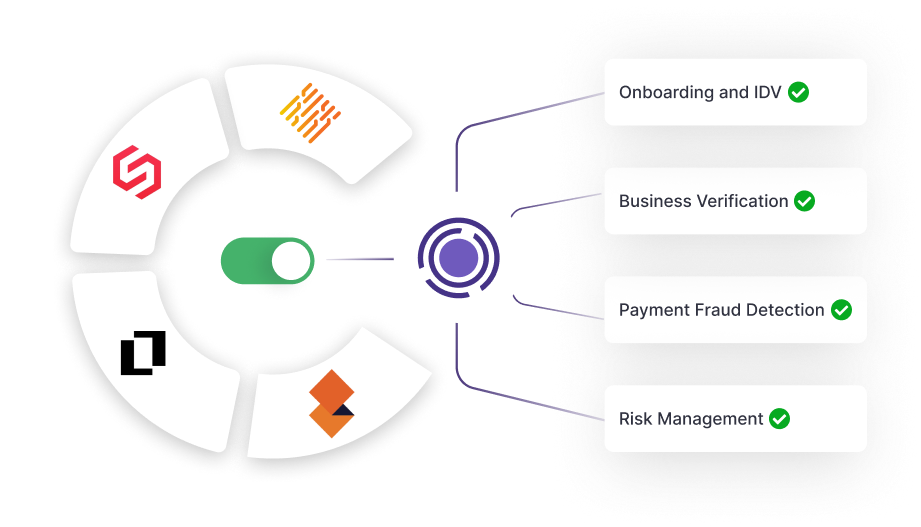

Gone are the days of painful vendor negotiations and one-off integrations. Effectiv unlocks the best data service providers at no mark up cost, all through one API integration.

Over the past decade we've helped financial institutions and fintechs of all sizes build flexible, scalable fraud and compliance automation processes. When you partner with Effectiv, you get access to world-class expertise through our solutions team to integrate your existing risk processes and scale them for long-term success.

Easily implement sophisticated risk strategies with multiple data services, all without writing a single line of code.

Unlock the power of multiple machine learning models to detect suspicious patterns and stop fraud loss before it’s too late.

Easily manage cases and alerts with event & entity-level data to make more informed review decisions, all without switching between multiple systems.

Leverage the best fraud and risk data at-cost to build identity, onboarding, fraud and AML decisioning flows.

DeviceIntel creates a unique device fingerprint using real-time OS, device data & pattern matching to identify suspicious behavior.

Security is at the heart of everything we do. Gain the benefits of a cloud-based solution with enterprise-grade data encryption, audit logs, RBAC, and more.

Effectiv is a real-time fraud & risk decisioning platform for FIs & Fintechs. Enable AI-driven solutions for onboarding, transaction monitoring, underwriting, authentication events, and more.

© 2024 Abra Innovations, Inc | All rights reserved | Privacy Policy | Terms of Use