FRAUDAY Newsletter

October 13th, 2023

Learn into how to automate KYB and UBO verification & catch up on the latest news at the intersection of AI x fraud.

FRAUDAY Newsletter

October 13th, 2023

Learn into how to automate KYB and UBO verification & catch up on the latest news at the intersection of AI x fraud.

ISSUE #6 | October 13th, 2023

Welcome to the FRAUDAY Newsletter

The spooky edition!

You’re joined by 500+ fraud and compliance professionals receiving curated industry insights, product updates, tips, and announcements directly in your inbox once a month.

Let’s GO 👇

Streamline Your KYB Process 🗂️

Verifying business information can be a difficult and potentially lengthy process. Information can be tough to find, and all beneficiaries must also go through the traditional KYC (Know Your Customer) process.

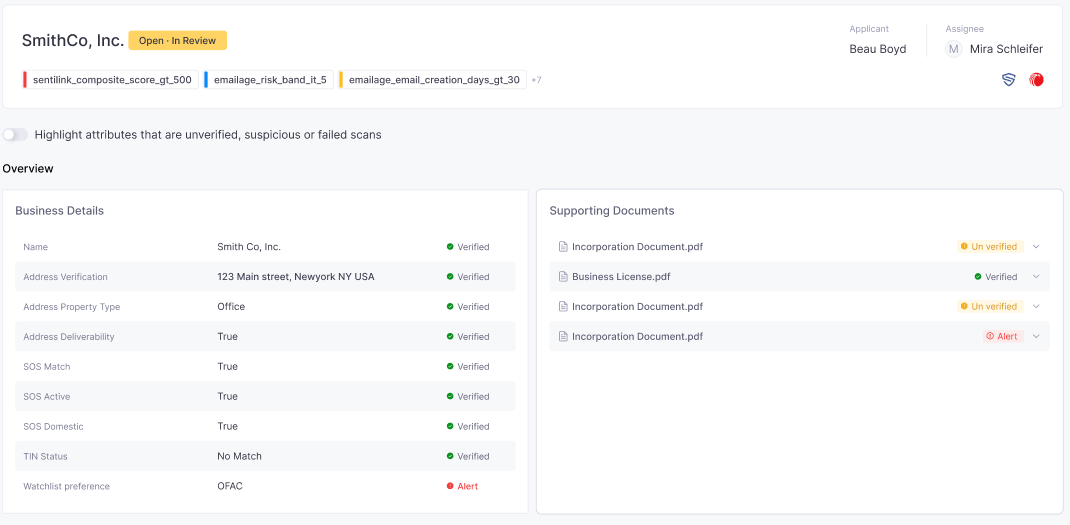

Now, you can leverage Effectiv’s world-class automation tools and our numerous data integrations to streamline your KYB onboarding processes and reduce manual efforts by your team!

Automated API-enabled Business Onboarding

Most KYB solutions require users to manually enter business and beneficiary data. With Effectiv’s API integration, all that data can be transmitted instantly, and our workflow automation system can perform necessary verifications and validations, watchlist checks, adverse media searches, and more.

Automating KYB checks allow you to onboard businesses faster, eliminating any manual work in the process.

Beneficiary Verification

Effectiv’s KYB solution isn’t limited to just verifying businesses. We’ve packaged our already robust KYC features into the automated KYB process, ensuring that both businesses and their beneficiaries can be verified quickly and efficiently.

Utilizing data sources such as Socure and Sentilink, we can ensure that beneficiaries are verified with the most accurate and complete information.

KYB Data Integrations

Effectiv features a robust library of data source integrations from some of the best names in the industry, ready to be used in your onboarding process.

Here are a few integrations that specialize in KYB:

✅ Middesk

Middesk provides a complete and accurate view of your customers, including entity names, officers, business addresses, TIN verification, and watchlist screening. Whether you’re looking to onboard businesses for payment processing, issue lines of credit, or open a new commercial account, Middesk can help.

✅ Kyckr

Kyckr provides registry and beneficiary data from most US states and over 100 international countries and jurisdictions. Kyckr helps to satisfy complex regulations with accurate, up-to-date company information quickly and easily.

✅ ComplyAdvantage

ComplyAdvantage provides anti-money laundering technology using artificial intelligence, machine learning and natural language processing to help regulated organizations manage risk obligations and counteract financial crime. It provides risk data for businesses and individuals to ensure your onboarding process is low-risk and reliable.

Events & Conferences 🔊

📆 Upcoming Events

- October 16th-17th – BHG Bank Network Summit – Ft. Lauderdale, FL

- October 16th-19th – Jack Henry Connect – Indianapolis, IN

- October 22nd-25th – Money 20/20 – Las Vegas, NV

- November 6th-8th – VentureTech – Dallas, TX

In The News 📰

🆔 Can ‘risk orchestration’ be businesses’ defense against financial crimes?

Organizations using multiple systems and siloed data face an ongoing challenge of balancing evolving compliance requirements, rising fraud and escalating customer expectations amid digital acceleration.

Read ↗️

🌐 Combining Old and Newer Technologies Helps Banks Fight Rising Fraud

A significant 47% of retail banking consumers under the age of 40 have been a victim of some form of banking fraud, shining a spotlight on the vulnerability of young people in today’s digital age. Additionally, half of those who are financially overextended — having more debt than they can repay — have fallen victim to fraud.

Read ↗️

❌ Chargebacks in 2023: What Do Merchants Need?

In terms of chargeback support, what do merchants need? The answer to that question varies, as every business faces its own unique problems. Moreover, the chargeback process is complex and ever-changing. That makes it hard to determine effective response strategies.

Read ↗️

💻 Social media: a golden goose for scammers

Scammers are hiding in plain sight on social media platforms and reports to the FTC’s Consumer Sentinel Network point to huge profit. One in four people who reported losing money to fraud since 2021 said it started on social media.

Read ↗️