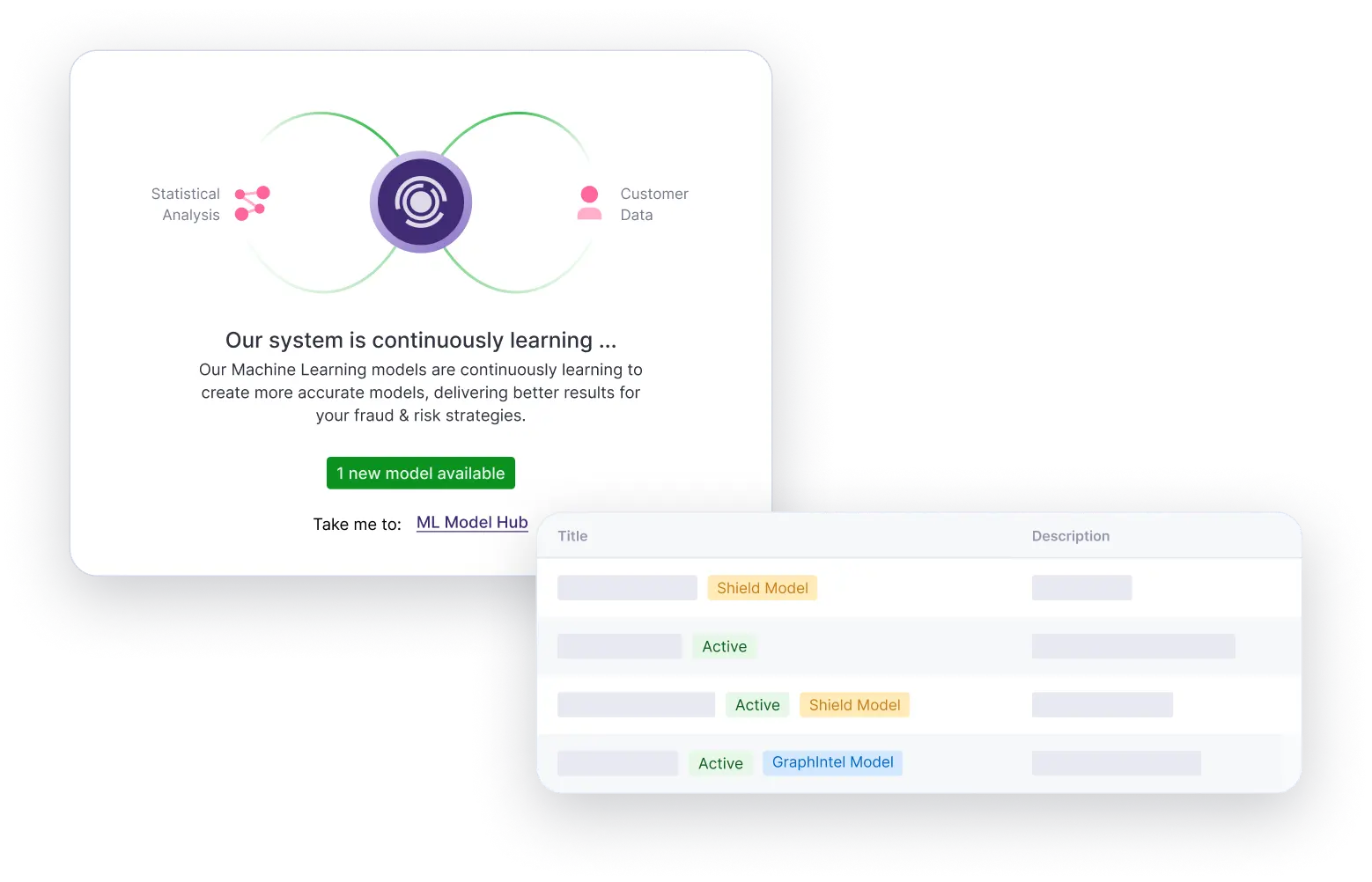

Transform your fraud detection strategy with the power of machine learning. The AI/ML Model Library puts a comprehensive catalog of cutting-edge machine learning models at your fingertips - ready to deploy instantly for proactive insights you can trust.

By providing a constantly evolving catalog of machine learning models, the AI/ML Model Library will help your fraud & risk team prepare for future attacks before they happen. With regular model refreshes and new additions, you can rest assured your fraud strategy leverages the latest techniques to detect and mitigate fraud.

Machine Learning Models available in our model library can be directly incorporated into a workflow via the 'ML Enrichment Step,' making it easier than ever to enhance your existing fraud and risk management strategy with advanced ML models.

Our pre-trained models put the power of big-data to work immediately, identifying hidden patterns and anomalies specific to your business from day one. When you're ready, implement a custom-trained model that leverages your feedback data to continuously learn and deliver incredibly accurate predictions tuned precisely for your use-case.

Our Shield Model empowers you organization with continuously improving risk data, trained on your customer's transaction history. Leveraging advanced feature engineering, statistical analysis, and automated model training, Shield Models adapts to emerging risks, ensuring you're always one step ahead of possible exploits.

Our Detect Model offers immediate, data-driven insights without needing historical data. Detect is ideal for institutions looking for an out-of-the-box machine learning model to deploy on day one to flag suspicious activities.

Our GraphIntel Model transforms data entities into a dynamic network graph, useful for identifying fraud rings and zeroing in on suspicious data points throughout the entire network. By leveraging machine learning, the algorithm meticulously evaluates each node's connections and their associations with fraudulent nodes.

Effectiv is a real-time fraud & risk decisioning platform for FIs & Fintechs. Enable AI-driven solutions for onboarding, transaction monitoring, underwriting, authentication events, and more.

© 2024 Abra Innovations, Inc | All rights reserved | Privacy Policy | Terms of Use