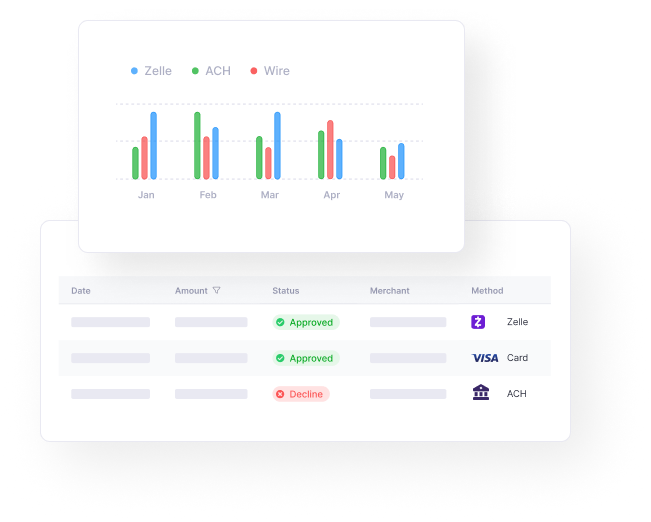

Stop payment fraud across multiple payment methods, including cards, ACH, Zelle, RTP, and FedNow by analyzing customer behavior, device and identity signals with sophisticated machine learning models.

Protect your customers from payment fraud at the time of transaction with machine learning and fully-customizable risk flows.

Protect transactions in real-time through the combination of purpose-built machine and world-class data service integration partners.

Implement security measures to accurately prevent payment fraud by employing a combination of graph-data, machine learning, and external data sources with customized rules to make decisions within milliseconds.

Utilize historical data in real-time to stop risky transactions and protect your customers.

Analyze transaction origins and detect advanced fraud patterns using deep device intelligence

Analyze transaction origins and detect fraud patterns using device intelligence data.

Detect fraud more effectively by analyzing connected data points using a unified entity data graph across all payment methods.

Improve the accuracy of your payment fraud detection by leveraging external data services, watchlists and bureau data.

“The platform’s ability to adapt to new threat vectors without extensive re-coding, combined with their partnerships with multiple validation vendors, provides us with the agility and coverage we need to protect our clients effectively.”

Director of Compliance

“Financial institutions are quickly realizing the potential of the rich data that comes with instant payments. With Effectiv, Pidgin offers a new way for financial institutions to leverage that transaction data and use it to combat fraud more holistically and effectively without relying on time-consuming back-end processes and manual workflows, which can make it difficult to process payments in a real-time environment."

Founder & CEO

“MANTL has a long-standing track record of mitigating fraud while providing a best-in-class customer experience during the account opening process. By partnering with Effectiv, we are expanding our delivery of industry-leading fraud detection, leveraging automation and configurability to meet every risk strategy. This partnership strengthens our platform and ability to drive growth for our customers.”

VP of Product

“With the speed at which money moves today, fraud detection needs to be just as fast. We’re thrilled to be partnering with Effectiv and enabling customers to combat fraud more holistically.”

Chief Platform Officer

"The transition from our previous solution to Effectiv has substantially enhanced my team's ability to make data-driven risk decisions and streamline our fraud detection process. The flexible nature of Effectiv's platform has allowed us to meet the evolving needs of our members and better manage risk across our organization."

VP, Audit & Risk

“We think of Effectiv like Android. You can go with their pre-built solution enabling one of the fastest go-to-market risk solutions to meet your customers where they are at or add your customization in a layered approach to enable seamless customer experiences.”

SVP, Financial Management

Effectiv is a real-time fraud & risk decisioning platform for FIs & Fintechs. Enable AI-driven solutions for onboarding, transaction monitoring, underwriting, authentication events, and more.

© 2024 Abra Innovations, Inc | All rights reserved | Privacy Policy | Terms of Use