FRAUDAY Newsletter

September 15th, 2023

Announcing the release of AI/ML Model Hub, plus recent fraud and artificial intelligence news to keep you up to speed!

FRAUDAY Newsletter

September 15th, 2023

Announcing the release of AI/ML Model Hub, plus recent fraud and artificial intelligence news to keep you up to speed!

ISSUE #5 | September 15th, 2023

Welcome to the FRAUDAY Newsletter

You’re joined by 500+ fraud and compliance professionals receiving curated industry insights, product updates, tips, and announcements directly in your inbox once a month.

Let’s GO 👇

Announcing: AI/ML Model Hub 🧠

Purpose-Built AI & Machine Learning Models for Fraud and Risk

Transform your fraud detection strategy with the power of machine learning. The AI/ML Model Hub puts a comprehensive catalog of cutting-edge models at your fingertips – ready to deploy instantly for proactive insights you can trust.

Our pre-trained models put the power of big data to work immediately, identifying hidden patterns and anomalies specific to your business from day one. When you’re ready, implement a custom-trained model that leverages your feedback data to continuously learn and deliver incredibly accurate predictions tuned precisely for your use case.

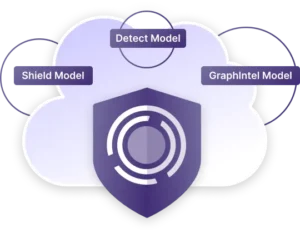

3 Different Model-Types

🛡️ Shield Model

Our Shield Model empowers your financial institution with continuously evolving fraud prevention, trained on your data. Leveraging advanced feature engineering, statistical analysis, and automated model training, Shield Models adapt to emerging risks, ensuring you’re always one step ahead of possible exploits.

🔍 Detect Model

Our Detect Model offers immediate, data-driven insights without needing historical data. Detect is ideal for institutions looking for an out-of-the-box machine learning model to deploy on day one to flag suspicious activities.

🌐 GraphIntel Model

Our GraphIntel Model transforms data entities into a dynamic network graph, useful for identifying fraud rings and zeroing in on suspicious data points throughout the entire network. By leveraging machine learning, the algorithm meticulously evaluates each node’s connections and their associations with fraudulent nodes. Risk scores associated with each entity can then be utilized to flag potential fraud or risky individuals.

If you want to implement the ML Enrichment step in your workflow, reach out to us at [email protected]

Featured Data Integrations 🧰

🧿 MaxMind

MaxMind’s industry-leading minFraud service helps businesses prevent fraudulent online transactions and reduce manual review. The minFraud service screens over 175 million e-commerce transactions and account registrations a month. Over 7,000 e-commerce and other online businesses benefit from the minFraud service through their client and partner networks.

🆔 Vouched

Get dependable digital identity verification solutions for your business with Vouched. Their customized workflows make KYC regulatory compliance a frictionless process, seamlessly integrating with your products to speed up customer onboarding.

Events & Webinars 🔊

📆 Upcoming Events

- September 18th-19th – Aite Financial Crime Forum – Charlotte, NC

- October 2nd-4th – ACAMS Conference – Las Vegas, NV

- October 4th-7th – CUNA Tech Council Conference – Denver, CO

- October 16th-18th – BHG Bank Network Summit – Ft. Lauderdale, FL

- October 16th-18th – Jack Henry Connect – Indianapolis, IN

💻 Upcoming Webinar

From Vulnerability to Vigilance: Strategies to Protect Your Credit Union Against Fraud

Tuesday, September 19th @ 2pm EST

Register now ↗️

In The News 📰

🗂️ SAR Filing – Common Problems and How to Navigate Proper Filing

The accuracy and comprehensiveness of SARs are crucial for law enforcement agencies to investigate and prevent financial crimes, and there are a few pitfalls that teams should be aware of to ensure that law enforcement can do its job effectively.

Read ↗️

🌐 The Modern Fraud Dilemma: It’s Good AI Against Bad AI

In a high-stakes cyber arms race supercharged by AI, financial institutions must balance cutting-edge, real-time tech defenses with strong human elements to thwart increasingly sophisticated fraudsters and protect both assets and data.

Read ↗️

🧠 What is FraudGPT?

FraudGPT is a product sold on the dark web and Telegram that works similarly to ChatGPT but creates content to facilitate cyberattacks.

Read ↗️

💻 The Simple Fraud Rule I Used To Crush Fraud Losses

My boss at the time said to me, “Find a Way To Help Us Reduce Fraud By 75%” Little did I know at the time, that within 30 days I would stumble upon an amazingly simple fraud rule that would help us crush fraud.

Read ↗️