FRAUDAY Newsletter

May 12th, 2023

Manual Application and Reason Code Group product updates, FIS BizChex and QualiFile integrations, and more.

FRAUDAY Newsletter

May 12th, 2023

Manual Application and Reason Code Group product updates, FIS BizChex and QualiFile integrations, and more.

ISSUE #1 | May 12th, 2023

Welcome to the FRAUDAY Newsletter

Welcome to the inaugural edition of Frauday, our monthly newsletter designed to keep you at the forefront of fraud, risk, and how AI/ML is shifting this ever-evolving landscape.

Each month we’ll bring you the latest product updates from Effectiv, handpicked news from the fraud & compliance space, stories about customers like you that are making waves in the industry, and details about upcoming events.

Let’s dive in 👇

Product Updates 💻

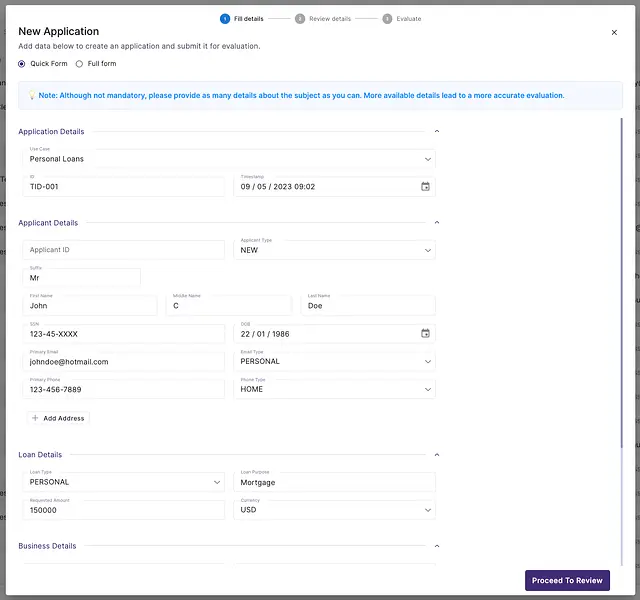

📑 Create Manual Applications

This new feature allows customers to create new applications without an API integration via a simple and easy-to-use form wizard. Users can now create ad-hoc cases to receive an instant decision!

New Manual Application form wizard ⬇️

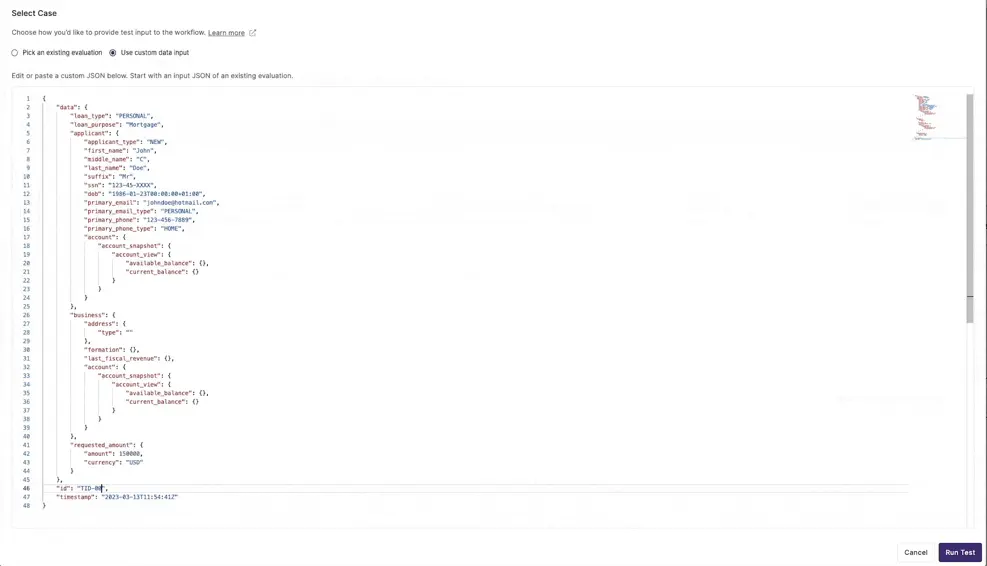

🏘️ Run Tests With Custom Data

This new feature allows our users to create their own test data for workflows to easily copy and edit data from existing cases, enabling more thorough and accurate testing of their workflows.

Check it out ⬇️

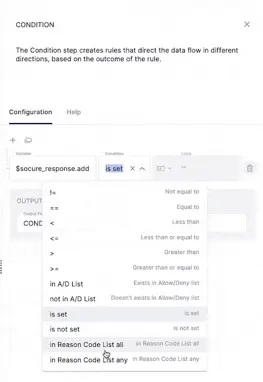

🏘️ Simplify Data Vendor Reason Codes With Groups

This feature allows users to create reusable groups for any workflow, streamlining the process and significantly reducing the steps needed to manage data vendor reason codes.

See how it works ⬇️

New Data Integrations 🧰

We are proud to announce three new 3rd party integrations to provide our users with a greater variety and choice of data to assist with their fraud prevention strategies.

✅ FIS BizChex

BizChex assists with risk underwriting and loss prevention for new small business account origination. It can access over 6 million business records, account closures, inquiries, business entity details, and more. This data, along with OFAC assessment, business and business owner identity verification, and more, provide a robust solution for small business assessment.

✅ FIS QualiFIle

For individual underwriting and loss prevention, QualiFile provides a powerful solution to automate the new account creation process, segment behavioral risk tolerance, and open up cross-sell opportunities. It provides a highly predictive, statistical risk assessment score and notices of ID Theft alerts or consumer-placed credit freezes.

🟠 Thomson Reuters CLEAR

CLEAR provides easy access to billions of public records that can be utilized for a vast array of use cases, including AML, insurance, healthcare fraud prevention, commercial lending, and many more. It assists with hard-to-find information, analyzing a subject’s connections, and quickly identifying key risk information.

Customer Spotlight 💡

Jason Sun

Director of Risk

“The most exciting aspect for our team is related to our risk, credit and

fraud policies and that we are able to do a lot by ourselves without

involving our Engineering team as a result of partnering with Effectiv.”

🚀 Key Use Cases

- Fraud Transaction Monitoring

- Automated Account Onboarding

- Case Management

Events & Webinars 🔊

🧠 Upcoming Webinar

Identity Fraud – Exploring Risks, Challenges, and Mitigation Strategies

Join Vivek Ahuja (Head of Enterprise Sales @ Sentilink), Michael Coomer (Manager, Fraud @ BHG), and Ravi Sandepudi (co-founder @ Effectiv) for an engaging discussion on May 23rd at 11:00am CST.

Sign up ↗️

📆 Upcoming Events

- May 16-18 – Eltropy User Conference – Salt Lake City, UT

- May 17-19 – New Jersey Bankers Annual Meeting – Palm Beach, FL

- May 23rd-25th – FinovateSpring 2023 – San Fransisco, CA

- May 30th-31st – Tech Week 2023 – San Fransisco, CA

- June 11th-14th – Florida Bankers Annual Meeting – Orlando, FL

In The News 📰

🕵️♀️ Real-Time Fraud Attempts

Spike 92%: With a 92% surge in attempted fraud transactions between 2021 and 2022, businesses must prioritize advanced technology, best practices, and extensive education.

🌐 AI and ML Spearhead Financial Crime Prevention

As AI and machine learning tools become crucial in bolstering anti-fraud and compliance measures, businesses are urged to adopt these proactive solutions to counteract increasingly sophisticated cybercriminal tactics.

🕸️ Network Graphs for Fraud Detection (3-Part Series)

Ravi Sandepudi (co-founder & CEO at Effectiv) documents stories from his days at Google, PayPal & Simility, working on the cutting-edge of leveraging network graph technology to fight fraud and identify fraud rings before the strike.

📈 Credit Unions Must Adapt to Real-Time Payments to Retain Members

Credit unions face a challenge in retaining members without matching the enhanced payment capabilities like real-time payment solutions offered by major banks and Fintechs.