FRAUDAY Newsletter

June 21st, 2024

Announcing the launch of our new Entity Framework and integration with Fiverity.

ISSUE #14 | June 21st, 2024

This community has grown to over 800 fraud & risk professionals, and we are thankful for each and every one of you.

We’ll keep the monthly tips, product updates, and industry insights coming your way. All we ask is if you find this newsletter helpful, please forward it to a colleague or friend. Thank you!

Product Update

Entity Framework

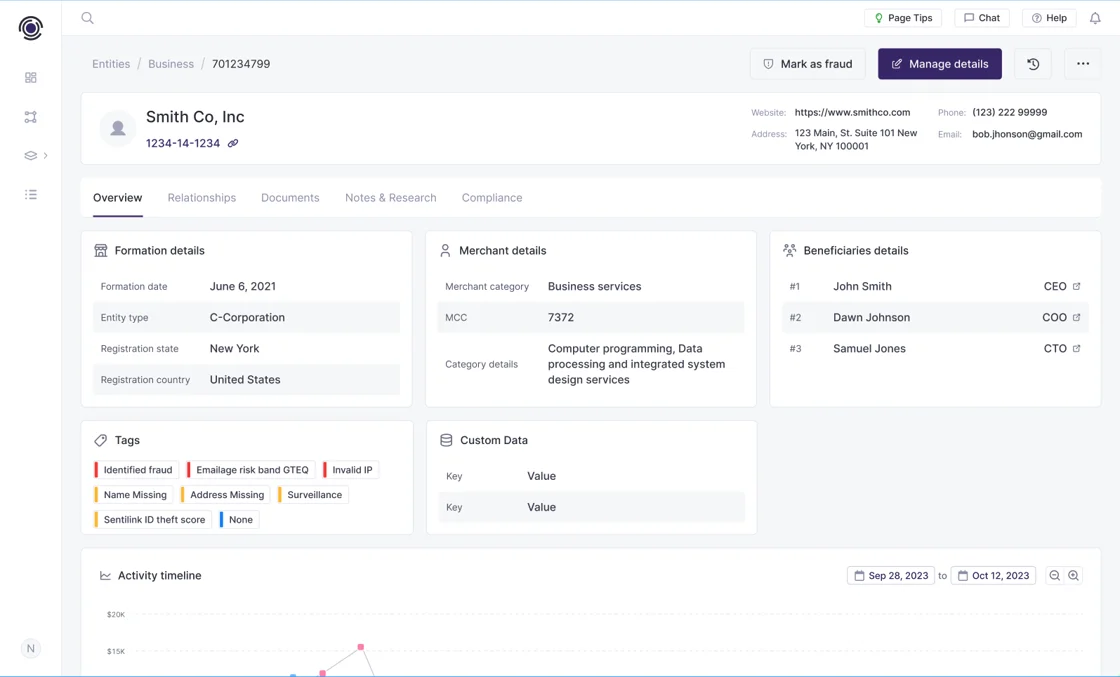

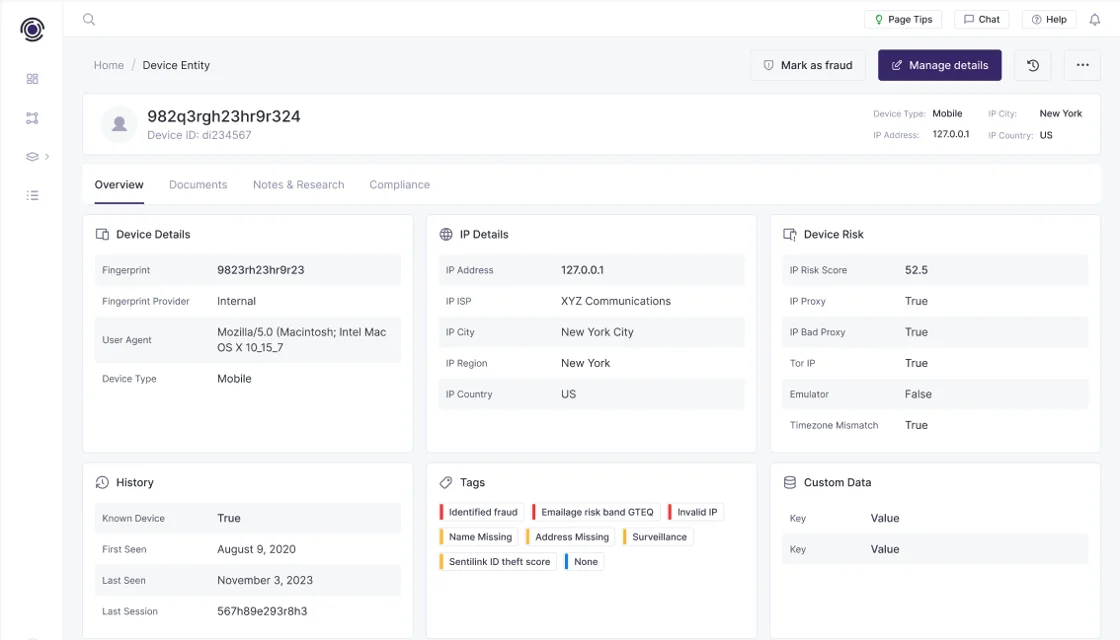

We’re proud to announce our new Complex Entity Framework, allowing users to view, manage, and maintain an individual, business, device, application, or custom entity within the platform. Complex Entities will allow our clients to create and work with more complete representations of their customer’s data and history.

Entities can be created from our existing Evaluation APIs. We are also launching a new Entity API that will enable entities to be created, edited, and updated asynchronously, even before a new onboarding, loan application, or other event.

Complex graph network relationships map entities throughout the system to provide a better understanding of interactions, shared data, and behaviors. Complex Entities will be accessible in our Workflow Builder and via our new Entity Profile pages (coming soon!)

(business entity)

(device entity)

Data Service Integrations

🔵 Fiverity

We’re excited about our new Fiverity TrustID integration, which will provide customers with advanced intelligence to evaluate trust for new customers. The integration will provide indicators for identity theft, synthetic fraud, and fraud history, including data breach history.

In The News

💳 Card Disputes Projected to Jump 40% as Friendly Fraud Persists

Consumers disputed around 105 million charges with U.S. card issuers last year, the report said, worth an estimated $11 billion. That’s up from $7.2 billion in 2019, the WSJ added, citing data from finance industry research firm Datos Insights. That company forecasts a 40% rise in that figure by 2026.

Read ↗️

⚡️ 5 Big Ideas: Making the Case for Instant Payments

In recent years, instant, P2P payments have seen a surge in adoption, emerging as a popular method for consumers to receive funds and make personal transactions and purchases. At the same time, smaller businesses have gravitated toward instant payments because they appreciate the speed, convenience and efficiency that comes from processing payments immediately.

Read ↗️

🏦 14 Next-Gen Fraud Solutions for Banks

Have you ever wondered how financial institutions protect themselves from sophisticated fraudsters? In this article, we look at some smart fraud solutions for banks to create a strong digital defense. Solutions focus on advanced security, sharing intel with other institutions, and building a central hub to manage it all. By doing this, banks not only save reputation and keep regulators happy but also build rock-solid trust with customers.

Read ↗️

🛜 How to Prevent Wire Transfer Fraud

Ever wondered what the wire transfer fraud landscape looks like in today’s tech-driven world? Safeguarding financial transactions demands unwavering vigilance against the ever-evolving threat of fraud. This blog uncovers sophisticated fraud tactics and innovative defenses, empowering financial institutions to protect assets and maintain customer trust.

Read ↗️