FRAUDAY Newsletter

June 16th, 2023

Learn more about our new Graph Network - Risk Scoring product update and new Springlabs & ValidiFi integrations.

FRAUDAY Newsletter

June 16th, 2023

Learn more about our new Graph Network - Risk Scoring product update and new Springlabs & ValidiFi integrations.

ISSUE #2 | June 16th, 2023

Welcome to the FRAUDAY Newsletter

Welcome back to Frauday, our monthly newsletter designed to keep you at the forefront of fraud, risk, and how AI/ML is shifting this ever-evolving landscape.

Each month we’ll bring you the latest product updates from Effectiv, handpicked news from the fraud & compliance space, stories about customers like you making waves in the industry, and details about upcoming events.

Let’s go 👇

Product Updates 💻

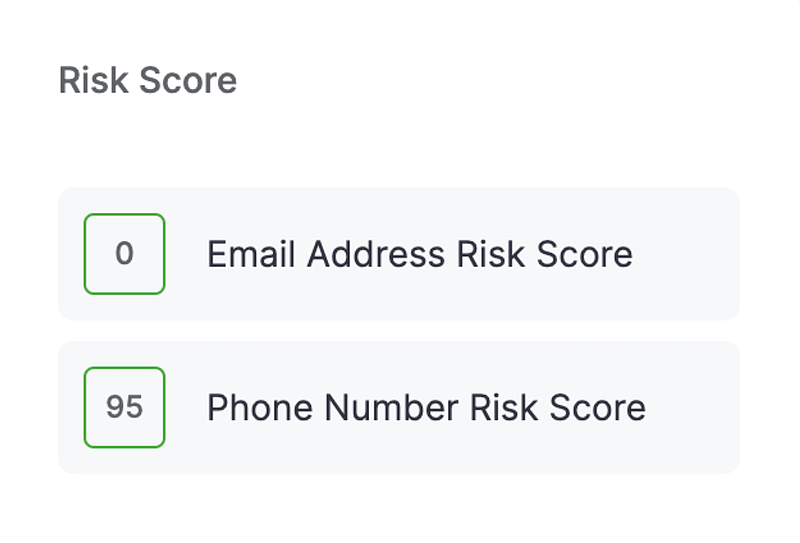

🌐 Risk Scoring – Graph Network

By utilizing advanced graph network capabilities, our platform can determine whether data is more or less risky based on analyzing related and interconnected data points. We can now provide you with a 0-100 risk score to assist in evaluating fraud.

- This allows review teams to make a faster and more efficient determination of fraud in manual reviews with an easy-to-understand format.

- It can be utilized in our workflow builder to assess risk based on data provided by your customers.

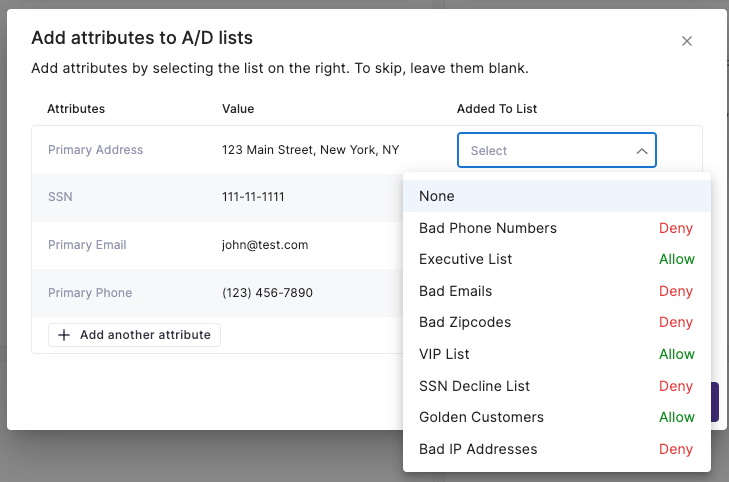

✅ Add Attributes to Allow/Deny List from Single Case View

We now allow users to add data to allow or deny lists directly from case view pages, creating a quick and easy way to ensure that the data on these lists are up-to-date.

Key Benefits:

- Reduced friction and improved efficiency in adding multiple data types to individual lists from the case view page.

- List additions are flexible and customizable, allowing users to add only relevant data to a list.

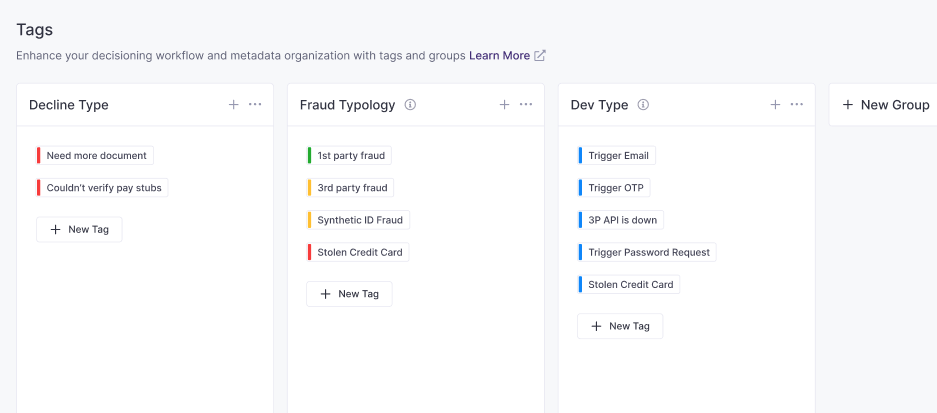

🏘️ Tags & Tag Groups

Tagging assists review teams with more easily recognizable signals, categorizing events, creating reason codes, and more.

Our new flexible tagging system empowers teams with a customizable solution that can be utilized throughout the platform.

Key Benefits:

- Highly customizable tagging that can be used for multiple purposes in the platform.

- The ability to group tags into different categories for better context when utilizing tagging.

New Data Integrations 🧰

🟩 ValidiFi

ValidiFi enables more robust Bank Account Validation for Account Onboarding workflows. Through ValidiFi, we can perform the following verifications:

- Bank Account Status and Capabilities

- Bank Account Transaction History

- Bank Account Ownership

Unlike other providers, ValidiFi doesn’t require user approval to be performed and relies on machine-learning techniques to extract insights.

ValidiFi can be leveraged on Account Onboarding workflows, as well as on any Account Funding verifications and ACH workflows.

🟦 Springlabs

Through their PLN product, Springlabs allows users to implement loan stacking strategies to Loan Application workflows.

With this integration, we can determine if a prospect has already applied for credit with other lenders, and make informed decisions, combined with other Loan Origination strategies, on whether it makes sense for your business to grant the loan.

✅ Kyckr

Kycker provides solutions to assist with the KYB process by aggregating global company registry data into a single source. It provides for effortless verification of business entities in a space where verifying can be a cumbersome process.

Customer Spotlight 💡

Haddy J. Coulibaly

SVP Operations

“In our world of fast payments, you want to make sure that your KYB solution accurately and quickly validates their identity. Effectiv’s system has that quick response. Effectiv is a company that we can continue to grow with over time.”

🚀 Key Use Cases

- Customer Onboarding

- Case Management

Events & Webinars 🔊

🧠 Upcoming Webinar

ML & XAI in Fraud Prevention: Past, Present & Future

Join Jonathan Doering (Co-Founder/Head of Product @ Effectiv), Ed Shee (Head of Developer Relations, Seldon), and Andrew Wilson (Solutions Engineer, Seldon) for this dynamic fireside chat on June 20th @ 11:00am CT.

Sign up ↗️

—————————————–

Identity Fraud – Exploring Risks, Challenges, and Mitigation Strategies

Join Vivek Ahuja (Head of Enterprise Sales @ Sentilink), Michael Coomer (Manager, Fraud @ BHG), and Ravi Sandepudi (co-founder @ Effectiv) for an engaging discussion on June 29th at 11:00am CT.

Sign up ↗️

—————————————–

Fraud, KYC & Ongoing Monitoring: 3 Important Pillars of Robust Risk Management

Join Ritesh Arora (COO/Co-Founder, Effectiv) and Deb Geister (VP Compliance & Regulatory, Socure) for an enlightening conversation on July 11th at 11:00am CT.

Sign up ↗️

In The News 📰

🕵️♀️ 3 Ways Credit Unions Can Digitally Reduce Fraud

Credit unions can reduce fraud and protect member experience by implementing a layered risk mitigation strategy that includes real-time verification, comprehensive data insights, and synthetic ID detection.

Read more ↗️

🗂️ The Importance of Compliance in Bank-FinTech Relationships

US regulators have provided crucial guidance for banks to ensure their fintech partners adhere to fair lending, privacy, and anti-money laundering laws, with specific steps to prevent regulatory gaming and enhance accountability.

Read more ↗️

⏳ Time Series of Events To Catch Fraudsters

Ravi Sandepudi breaks down how to leverage Google-like auto-complete technology to spot suspicious sequences in financial transactions, turning ordinary activities into a revealing tale of potential fraud.

Read more ↗️

🪪 Behavioral-Driven Fraud Is Having a Modern-Day Renaissance

Fueled by technology like AI and targeting human vulnerabilities, businesses must arm themselves with innovative fraud detection solutions and education about cyber threats to protect their organization.

Read more ↗️