FRAUDAY Newsletter

July 19th, 2024

Learn about Decision Rules, three new data integrations, and follow Effectiv on social.

ISSUE #15 | July 19th, 2024

This community has grown to over 800 fraud & risk professionals, and we are thankful for each and every one of you.

We’ll keep the monthly tips, product updates, and industry insights coming your way. All we ask is if you find this newsletter helpful, please forward it to a colleague or friend. Thank you!

Product Update

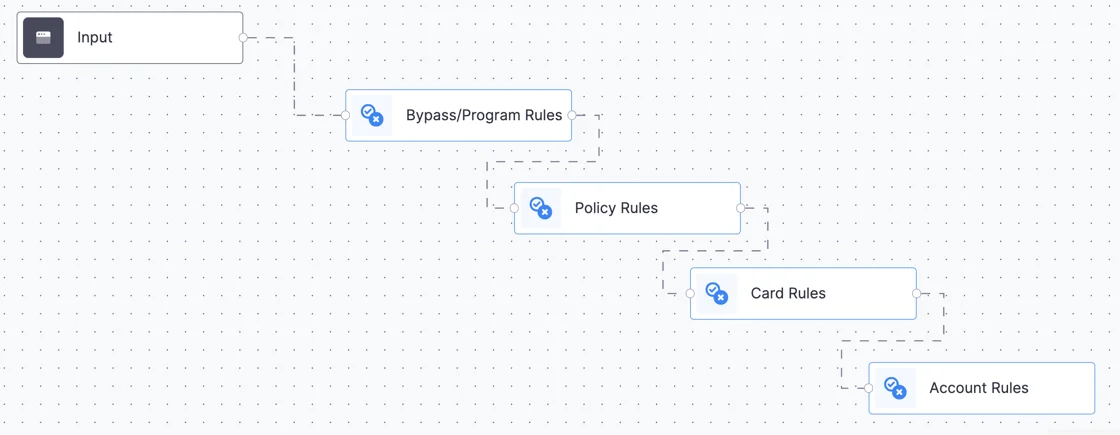

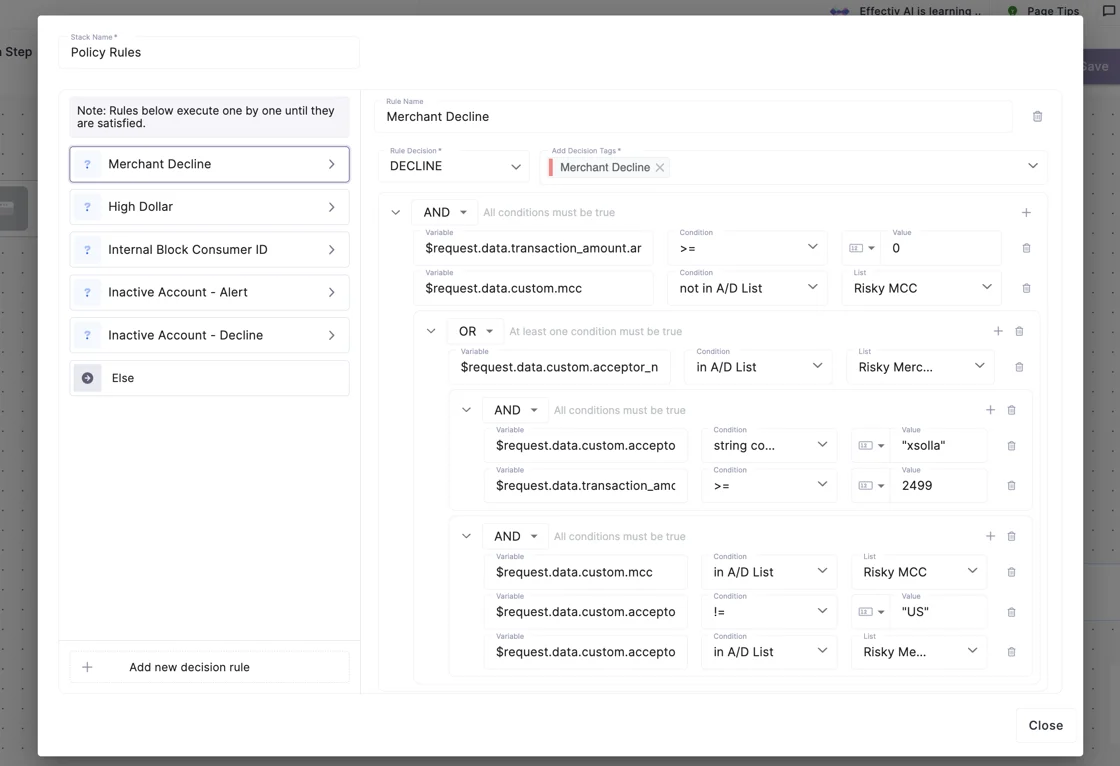

Decision Rules

We’re excited to announce our new Decision Rules feature, which simplifies complex and lengthy rule writing. The feature enables users to utilize a new Decision Rules step in Effectiv’s workflow builder to create multiple conditions that are executed in sequence using an intuitive rule creation process. Users can sequence the conditions and rules, using drag-and-drop functionality to move them to the appropriate order.

The Decision Rules feature will allow users to create more powerful and organized rulesets, which will be especially helpful in rule-heavy use cases like transaction monitoring.

(decision rules)

(decision rule builder)

Data Service Integrations

🔴🟡 Mastercard Match

Mastercard developed MATCH to give acquiring banks a way to identify high-risk merchants before engaging in merchant agreements. Being on the MATCH list can potentially result in you losing any active, legitimate merchant accounts you presently have, and it will make it impossible for you to open any new ones.

🏦 iSoftpull

iSoftpull is an authorized reseller of Equifax, TransUnion, Experian, and FICO® Scores. Their APIs allow a customer to access credit details and scores from all 3 major credit reporters.

🌐 Ocrolus

Ocrolus provides an automated document and data analysis platform that uses machine learning to process and analyze financial documents with high accuracy and efficiency, enhancing decision-making and reducing manual effort.

Find Effectiv on Social Media!

In The News

🤝 When foes become friends: Capital One partners with fintech giants Stripe, Adyen to prevent fraud

In an unusual move, Capital One is teaming up with payment giants (and rivals) Stripe and Amsterdam-based Adyen to offer a free product aimed at fraud reduction, the financial services giant told TechCrunch in an exclusive interview.

Read ↗️

📲 What’s worse than thieves hacking into your bank account? When they steal your phone number, too

Using my home Wi-Fi connection, I checked my email and discovered a notification that $20,000 was being transferred from my credit card to an unfamiliar Discover Bank account.

Read ↗️

🆔 Synthetic Identity Fraud: What It Is & How To Stop It

Read ↗️

🏦 Banks should proactively tackle instant payments fraud

The irrevocability of instant payments, whether through peer-to-peer or real-time channels, is shaping up to be a fraud risk, especially since users can willingly send money to scammers.

Read ↗️