FRAUDAY Newsletter

April 19th, 2024

Two Workflow Builder quality-of-life updates + learn about our brand-new AI-powered KYB Agent for business verifications.

ISSUE #12 | April 19th, 2024

Happy Frauday! Get it? Fraud + Friday? Anyway…

This community has grown to over 800 fraud & risk professionals, and we are thankful for each and every one of you.

We’ll keep the monthly tips, product updates, and industry insights coming your way. All we ask is if you find this newsletter helpful, please forward it to a colleague or friend. Thank you!

Product Updates

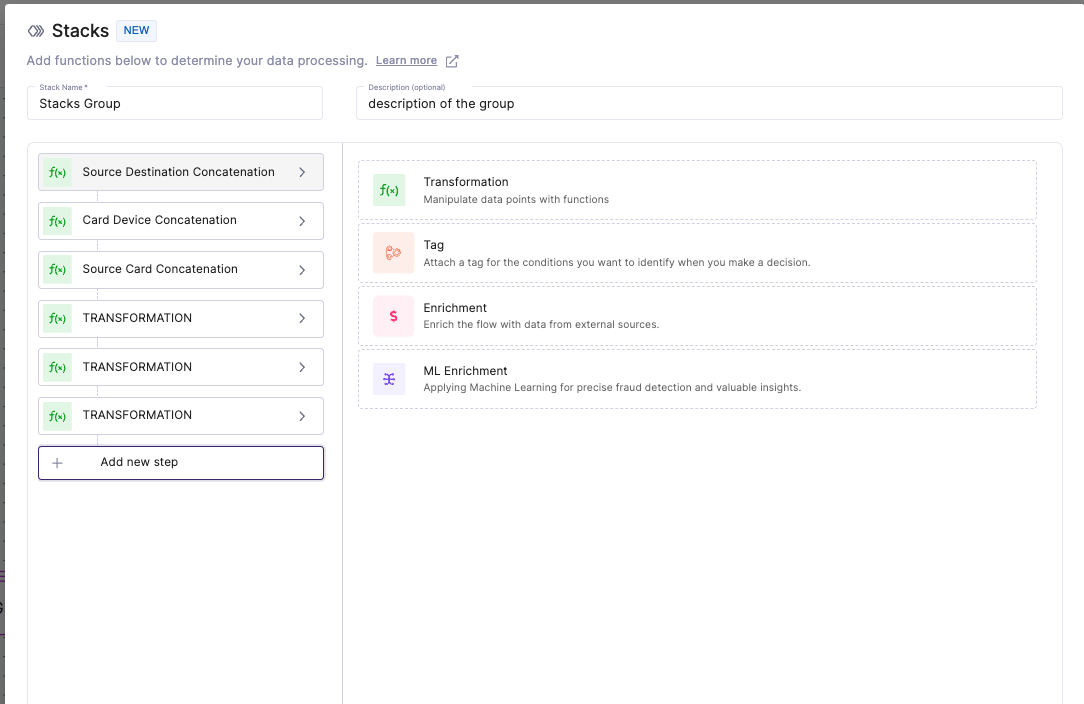

Stacked Steps in Workflow Builder

Workflows can sometimes contain more than 100+ steps, which is quite visually complex. In an effort to simplify multi-step workflows, we launched Stacked Steps. Stacked Steps introduces a new, easy way to group a series of steps to make workflows much more clear visually and easier to understand.

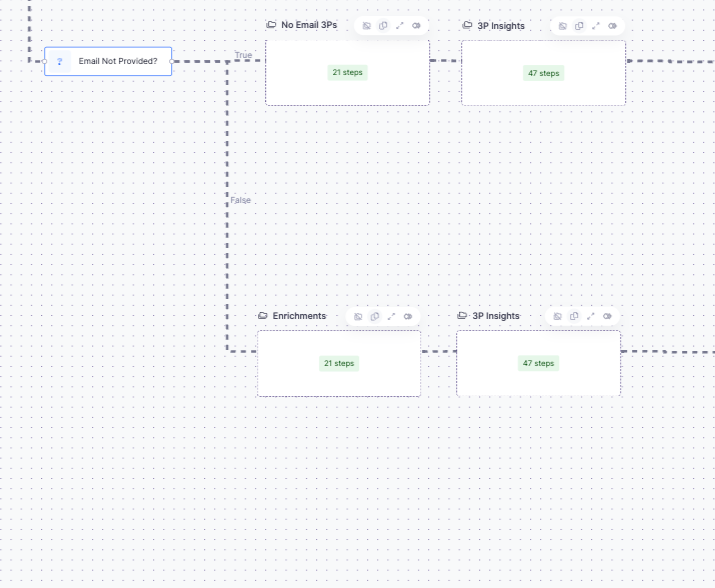

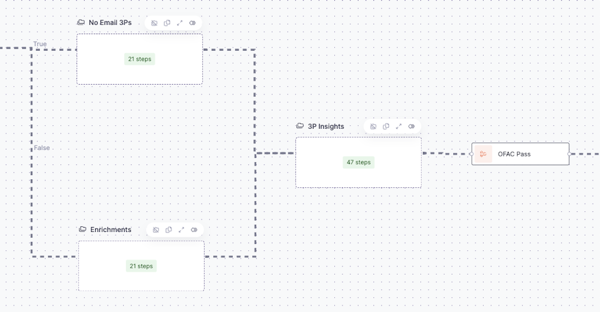

Multi-Parent Steps in Workflow Builder

We’re excited to announce the release of the Multiple Parent Steps feature, a key part of our ongoing efforts to simplify workflows. This new capability allows multiple branches in a strategy to converge back to an individual flow, eliminating the need for repetitive steps across different workflow branches.

(Previous Workflow Builder UI)

(New Workflow Builder UI)

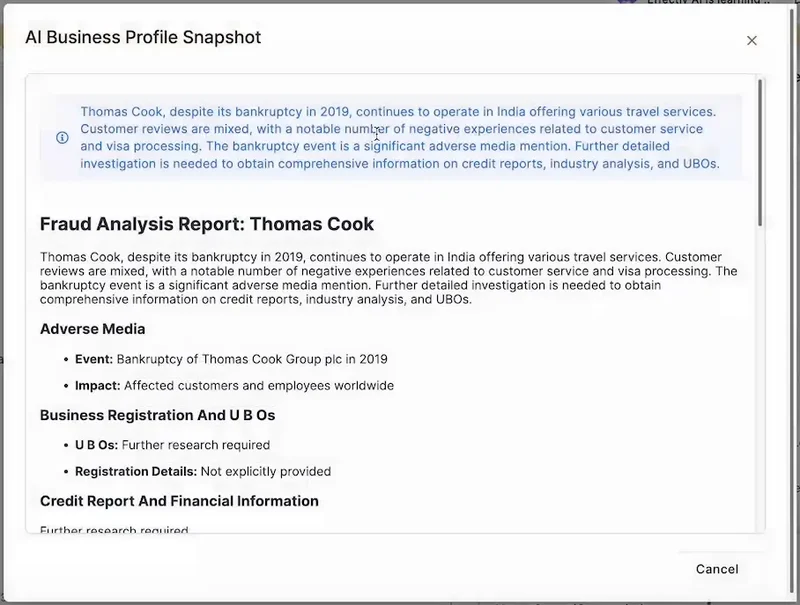

KYB Agent

Introducing KYB Agent, an AI-powered tool that automates the collection of extensive business details and customer reviews from multiple online sources, streamlining KYB procedures for financial institutions and fintechs. By reducing manual research time, increasing accuracy, and enhancing compliance, KYB Agent allows users to focus on strategic decision-making rather than manual data collection.

Events & Conferences

📆 Upcoming Events

NACHA Payments | May 6-9 | Miami, FL

In The News

🥷 Hackers are threatening to leak World-Check, sanctions and financial crimes watchlist

World-Check is a screening database used for “know your customer” checks (or KYC), allowing companies to determine if prospective customers are high risk or potential criminals, such as people with links to money laundering or who are under government sanctions. The hackers told TechCrunch that they stole the data from a Singapore-based firm with access to the World-Check database, but did not name the firm.

Read ↗️

🏦 President Biden’s Sweeping Proposals to Crack Down on Pandemic Fraud and Help Victims Recover Introduced in Congress

Senate Homeland Security & Governmental Affairs Committee is introducing major new legislation, the Fraud Prevention and Recovery Act—modeled on President Biden’s Sweeping Pandemic Anti-Fraud Proposal highlighted in the Fiscal Year (FY) 2025 Budget—to crack down on systemic pandemic fraud across government programs and help victims of identity theft recover.

Read ↗️

🆔 A Layered Approach to Combat Synthetic Identity Fraud

With fraud losses growing rapidly it begs the question: Exactly who should address the issue? The dealer? Lender? Technology service provider? The answer is most likely all of the above.

Read ↗️

💸 Americans lose millions of dollars each year to wire transfer fraud scams. Could banks do more to stop it?

Americans are losing millions of dollars every year to criminals who steal money from their bank accounts through fraudulent wire transfers. Some U.S. senators are now pressing major banks for answers about what they are doing to stop the scammers.

Read ↗️