FRAUDAY Newsletter

July 14th, 2023

Learn about the latest FinCEN SAR filing product update, Finicity and Plaid Identity API integrations and more.

FRAUDAY Newsletter

July 14th, 2023

Learn about the latest FinCEN SAR filing product update, Finicity and Plaid Identity API integrations and more.

ISSUE #3 | July 14th, 2023

Welcome to the FRAUDAY Newsletter

Welcome back to Frauday, our monthly newsletter designed to keep you at the forefront of fraud, risk, and how AI/ML is shifting this ever-evolving landscape.

Let’s dive in 👇

Product Updates 💻

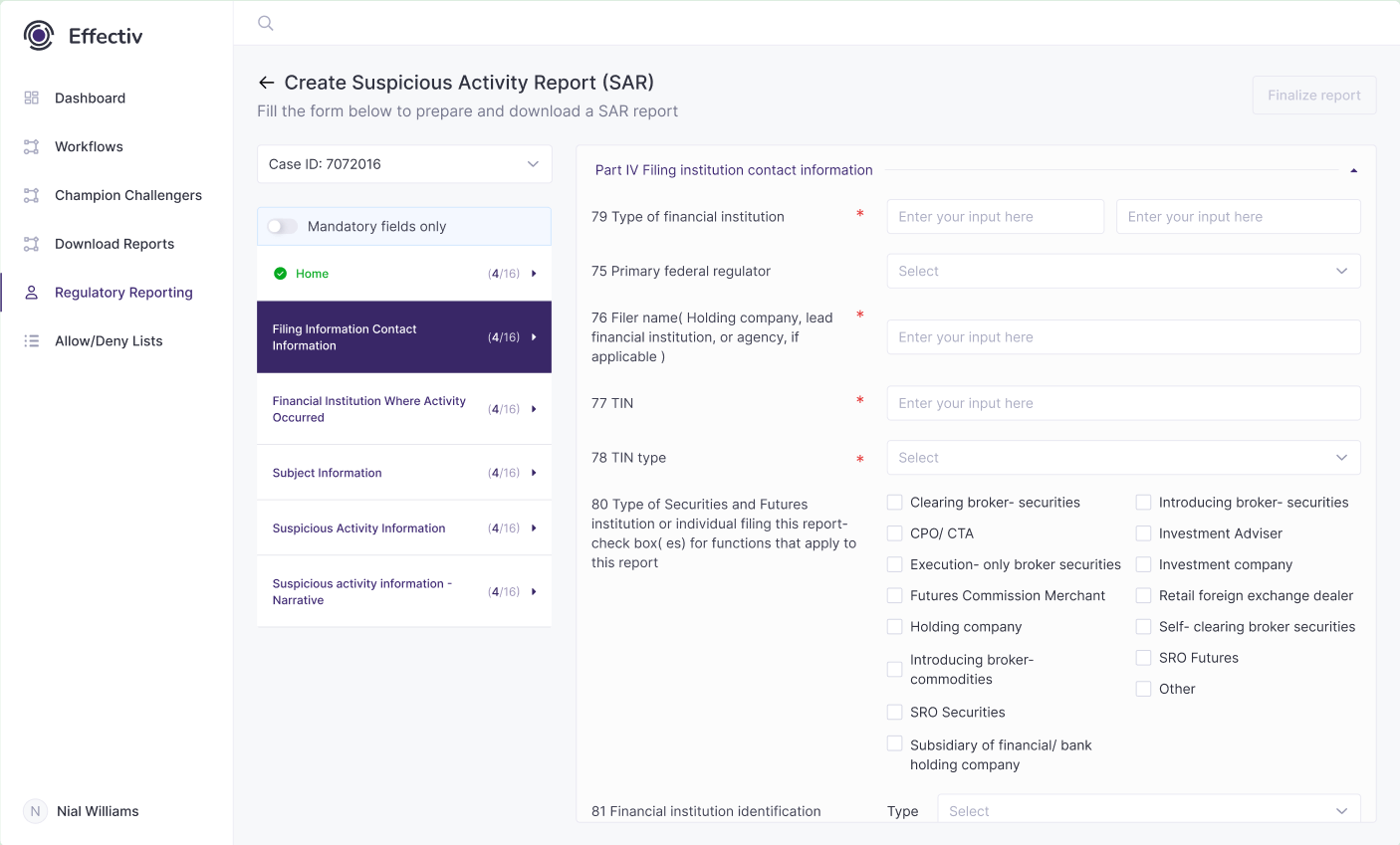

📄 FinCen SAR Filing

We are excited to introduce our new in-app SAR (Suspicious Activity Report) feature, which allows teams to generate SAR reports to E-File on the FINCEN/BSA portal.

This feature will also pre-populate reports with case data, and maintain a complete history of SAR reports directly on the platform, further streamlining this process for your team.

Stay tuned for more FinCEN-related features coming soon!

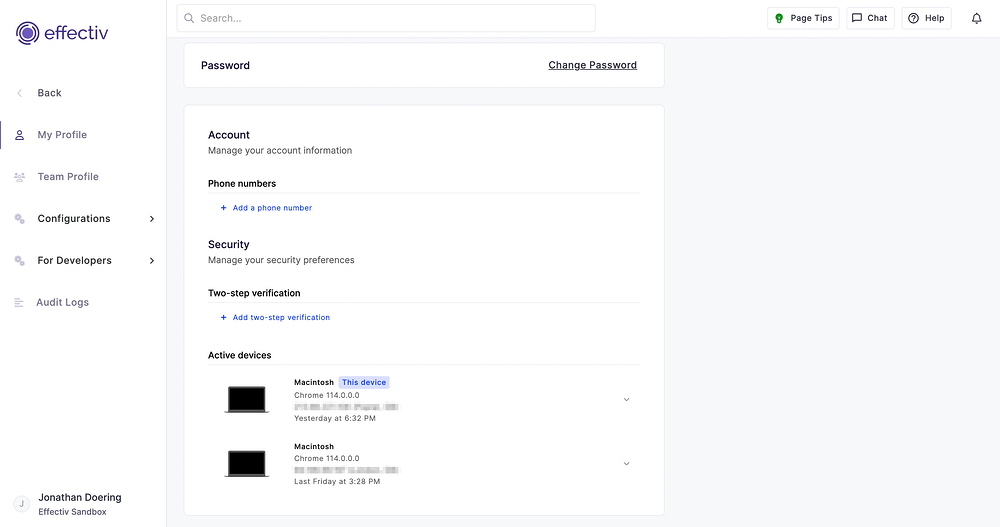

🔐 Advanced 2FA and Active Device Overview

We have expanded our Two-Factor Authentication (2FA) methods to include phone-based and authenticator-based authentication support. You’ll also see an Active Device Overview, which allows you to easily monitor and manage all the devices currently logged into your account. If you encounter unfamiliar devices, you can force a sign-out, ensuring that only trusted devices have access.

New Data Integrations 🧰

🔴🟠 Finicity

Finicity’s open banking solutions deliver consumer-permissioned financial data that empowers your workflow and unlocks new possibilities for you and your business. It allows your customers to provide easy access to their financial data so that you can make smarter decisions faster.

📲 Plaid Identity API

This API lets you retrieve your customers’ data, such as account holder names, addresses, email addresses, phone numbers, and more. By leveraging the Plaid Identity API, businesses can streamline user onboarding processes, verify customer identities, and enhance overall user experience.

Customer Spotlight 💡

Andrew Stone

SVP Financial Management

“BHG Financial selected Effectiv for their team’s depth of experience in the fraud space, flexibility to service a complex multi-product environment, and features that are a fraud executive’s dream. Effectiv is a competitive game changer for our business.”

🚀 Key Use Cases

- Loan Origination

- Underwriting

- Customer Onboarding

- Case Management

Events & Webinars 🔊

🧠 Upcoming Webinar

Faster & Safer Payments: How to Enable Next-Gen Payments for Your Account Holders

Learn how millennial & gen-z consumers expect flexibility in payments and why community financial institutions must provide experiences similar to new-age players by quickly and safely deploying RTP/FedNow for their account holders.

August 3rd @ 12:00pm ET

Sign up ↗️

📆 Upcoming Events

August 16-18 – United Bankers’ Bank Operations Council Conference – Bloomington, MN

In The News 📰

⚡️ Insurance Firms Adopting Real-Time Payments

Insurance firms are turning to Fintech for help orchestrating real-time payments for B2B transactions, with speed and customer satisfaction as the main motivator.

Read more ↗️

🆔 Identity verification: How to strike a balance between speed and security

Madhvi Mavadiya, Head of Content at Finextra, explores the challenge of balancing speed and security in identity verification and the need for advanced technologies like AI and machine learning to ensure efficient and accurate verification processes without compromising user experience.

Read more ↗️

🌐 Using MapReduce To Catch Fraudsters

Ravi Sandepudi, Co-Founder & CEO at Effectiv, shares his experience combating complex account takeover schemes using MapReduce, a groundbreaking new technology developed by Google to process vast amounts of login data and detect anomalies in user behavior.

Read more ↗️

💰 Growing Threat of Deepfakes Drives Fintechs to Boost Fraud Budgets

A recent report found that Fintechs, on average, lose $51 million every year to fraud — an approximate median of $400,000 — or the equivalent of 1.7% of their annual revenue.

Read more ↗️