FRAUDAY Newsletter

February 16th, 2024

3 brand-new product updates, Effectiv & Treasury Prime team up for transaction monitoring, and sign up for our upcoming webinars!

FRAUDAY Newsletter

February 16th, 2024

3 brand-new product updates, Effectiv & Treasury Prime team up for transaction monitoring, and sign up for our upcoming webinars!

ISSUE #10 | February 16th, 2024

You’re joined by 800+ fraud and risk professionals receiving curated industry insights, product updates, tips, and announcements directly in your inbox once a month.

Product Updates

We’ve made several significant improvements to our workflow functionality!

Workflow Search

Now, users can effortlessly search workflow steps by name, output, or condition operators, making it easier to identify field outputs and dependencies, as well as troubleshooting decision paths on cases in the workflow. This enhancement allows users to identify and locate specific steps within workflows quickly. To access this search functionality, use the cmd+f (Mac) or control+f (PC) shortcut when editing or viewing a workflow.

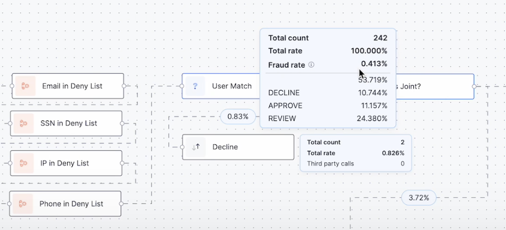

Workflow Metrics

Workflow Metrics introduces a metrics view, offering insights into the paths cases take through workflows, along with Approves, Declines, Reviews, and Fraud metrics for each workflow condition. This tool empowers strategists to refine strategies and troubleshoot behaviors. While metrics are fixed, users can change time parameters related to the workflow execution, ensuring insights are relevant and actionable.

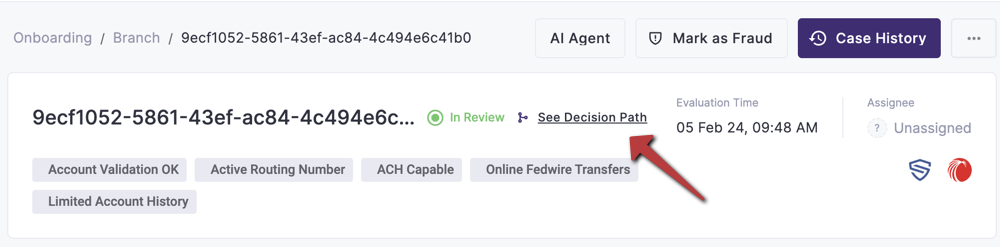

Workflow Pathfinder

With Workflow Pathfinder, users gain the ability to trace the exact path individual cases followed through the associated workflow, clearly seeing the steps leading to the decision of allow, decline, or manual review. This feature is a game-changer for case reviewers, providing deep insights into the relationship between workflows and individual cases, and facilitating targeted adjustments to improve automation and decision-making accuracy.

Partnership Announcement

Events & Conferences 🔊

📆 Upcoming Events

- Fintech Meetup – March 3-6 – Las Vegas, NV

- ePay Connect24 – March 11-13 – Orlando, FL

- CBA Live – March 25-27 – Washington, D.C.

💻 Upcoming Webinars

Mastering Account Onboarding with Socure

Tuesday, February 27th @ 1pm EST

Register now ↗️

The How-To Guide to Preventing Fraud in Real-Time with AI

Thursday, February 29th @ 1pm EST

Register now ↗️

In The News

📧 Underpinning Fraud Prevention with Email Data

The email address is becoming synonymous with digital identity. It is a key identifier that forms the basis for how most people engage with the world – through apps, social media, bank accounts, and so much more. But it is also an ideal target for malicious activity, with 75% of companies having experienced increased email-based threats.

Read ↗️

📲 Venmo, Zelle and Cash App Fraud Draining Bank Accounts

Alarmed by a surge in fraud draining bank accounts through popular mobile payment apps like Venmo, Cash App and Zelle, Manhattan District Attorney Alvin Bragg, Jr., has sent scathing letters to the CEOs of each company, demanding immediate action to protect consumers.

Read ↗️

🆔 People Are Using Basic AI to Bypass KYC

An underground service called OnlyFake is leveraging “neural networks” to craft high-quality fake IDs, and anyone can get instantly generated fake IDs with startling realism for just $15, potentially facilitating a range of illicit activities.

Read ↗️

🏪 How Walmart’s Financial Services Became a Fraud Magnet

By exploiting Walmart’s lax security, scammers have duped consumers out of more than $1 billion. The company has resisted taking responsibility while breaking promises to regulators and skimping on training.

Read ↗️