FRAUDAY Newsletter

August 18th, 2023

Announcing the release of DeviceAI, Credit Decisioning Matrix Rule Builder, plus recent developments to keep you up to speed on fraud and risk!

FRAUDAY Newsletter

August 18th, 2023

Announcing the release of DeviceAI, Credit Decisioning Matrix Rule Builder, plus recent developments to keep you up to speed on fraud and risk!

ISSUE #4 | August 18th, 2023

Welcome to the FRAUDAY Newsletter

Welcome back to our monthly newsletter! You’re joined by 500+ fraud and compliance professionals receiving curated industry insights, product updates, tips, and announcements directly in your inbox once a month.

Let’s dive in 👇

Announcing DeviceAI 🌐

Amplify Fraud Detection With DeviceAI Telemetrics and Intelligence

Built in-house at Effectiv, DeviceAI incorporates real-time analytics and device information to create a multi-layered security protocol. Leveraging AI, we create a digital fingerprint for each unique device by recognizing device-specific attributes and user-interaction patterns.

DeviceAI is designed to monitor and learn from every interaction continuously, enabling it to spot potential fraudulent activities -—all while maintaining privacy and a seamless user experience.

“After months of research and product development, we are very excited to launch DeviceAI, which will improve our solutions even more. Effectiv’s ability to look at all end-user interactions holistically helps us identify fraudulent transactions with very high accuracy in real-time.”

– Ritesh Arora, Co-founder & COO

If you want to try DeviceAI, reach out to us at [email protected]

Product Updates 💻

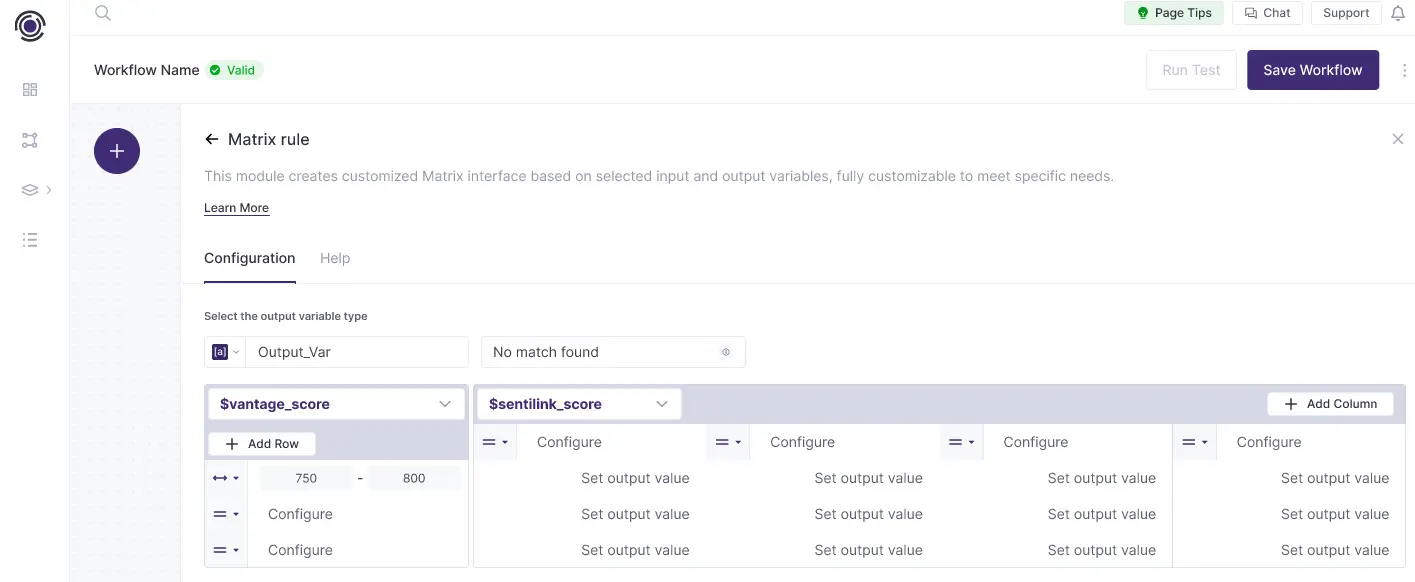

📄 Underwriting Matrix Rule Builder

Credit underwriting is the process of assessing the creditworthiness of a borrower or a potential borrower to determine their ability to repay a loan or fulfill their financial obligations. It involves analyzing various factors such as the borrower’s credit history, income, employment status, existing debts, and other relevant financial information.

Assessing credit for underwriting purposes can be complex, but luckily, this can be simplified by using industry-standard matrix rules. Our Matrix Rules builder is new to the Effectiv platform, which provides teams with a powerful way to utilize matrix rules in automated risk decisions.

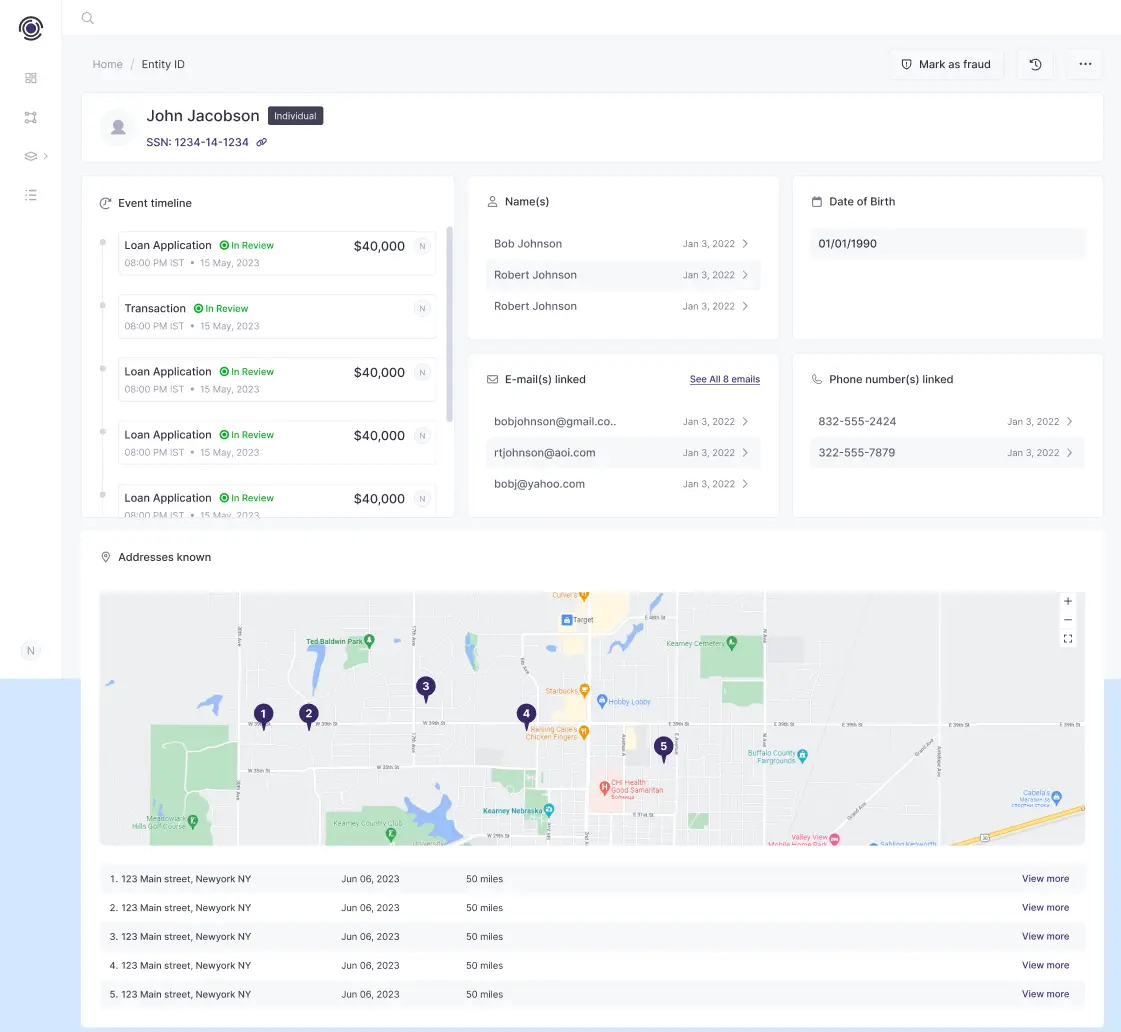

🗺️ Entity View

When your business involves multiple products or touch points for a customer, creating a holistic view of customer data and behavior can be tricky. To help with this, we are including a new Entity View page within the platform, which provides reviewers with an aggregated view of customer events, data, and more.

With a goal to assist review teams in spotting trends and anomalous data, as well as taking a deeper dive into a customer’s history, our new Entity View creates a window into better customer insights to ensure your team can confidently make accurate risk decisions.

Featured Data Integrations 🧰

🔴🟠 Socure

Socure’s predictive analytics solution applies AI & ML techniques with trusted online/offline data intelligence from email, phone, address, IP, device, velocity, and the broader internet to verify identities in real time.

🗄️ Middesk

Middesk is a business identity solution that enables customers to verify the legitimacy of any business.

Events & Webinars 🔊

📆 Upcoming Events

- August 23rd-25th – fintech_devcon – Austin, TX

- September 11th-13th – FinovateFall – New York City, NY

- September 11th-13th – Eltropy Leadership Summit – Sundance, UT

- September 13th-15th – ELEVATE: Credit Union Leadership Summit – Oklahoma City, OK

In The News 📰

🗂️ Everything You Need To Know About BSA Filing: SARs

Explore the ins and outs of BSA filing and SARs. Learn about who is required to comply with BSA reporting, how to file a report, and more.

Read more ↗️

🆔 Best Practices in Digital Identity Verification for Financial Institutions and Fintechs

In a digital-first world, opening accounts online has exploded, attracting more fraudsters than ever before with increasingly sophisticated tactics. Validating that every applicant is who they say they are is critical, requiring effective identity verification at every stage of the customer journey, from onboarding new customers to re-verifying returning customers and executing high risk transactions.

Read more ↗️

🧠 Are You Smarter Than a Scammer?

Learn more about how to keep yourself safe by testing your instincts below and guessing whether each instance is a scam, using real-life examples. You will also receive helpful advice on how to keep yourself and loved ones safe.

Read more ↗️

💰 The Generative AI’s Battle Between Companies and Hackers Is Starting

Generative AI’s role in making ransomware attacks and phishing schemes easier and more ubiquitous is not lost on chief information security officers and other cyber leaders trying to stay on top of this fast-moving technology.

Read more ↗️