The Guide to Fraud Detection and Prevention in Banking

This guide highlights the challenges faced by the industry and explores effective strategies to combat evolving threats. From advanced machine learning algorithms to real-time monitoring systems, discover cutting-edge technologies revolutionizing the way financial institutions protect their customers and assets. Understand how banks navigate the intricate corridors of fraud detection and prevention today.

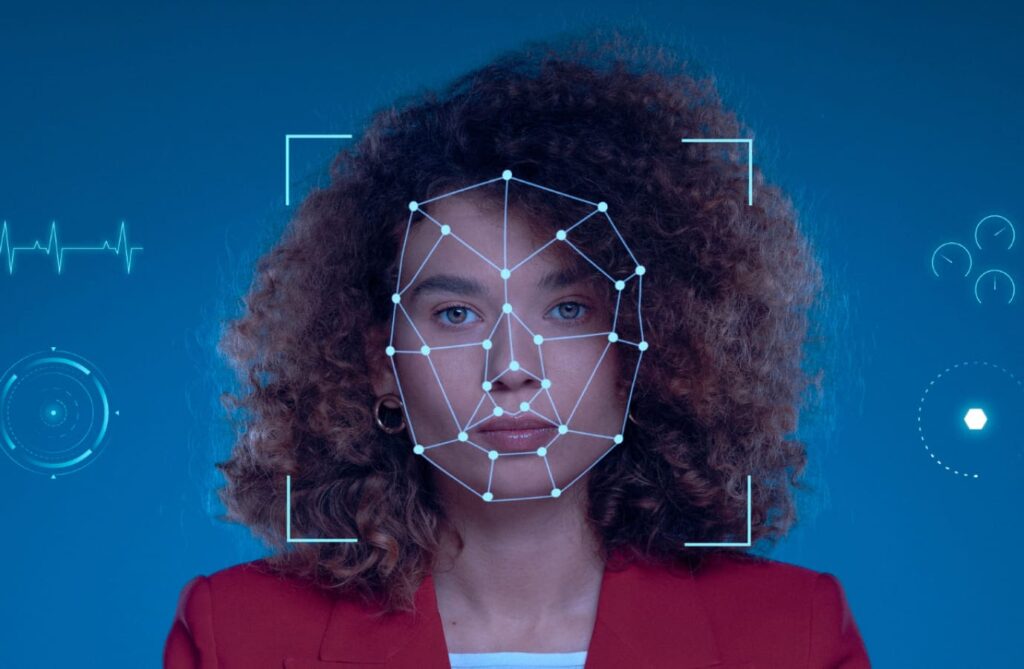

Payment Fraud Detection: Using AI to Stop Fraud in Real-Time

Learn about different kinds of payment fraud and how technologies like machine learning and natural language processing can help catch them. We share practical steps for businesses and FIs to set up their own fraud detection systems, touches on the importance of following privacy laws, and suggests ways to pick the right technology tools to keep payments safe.

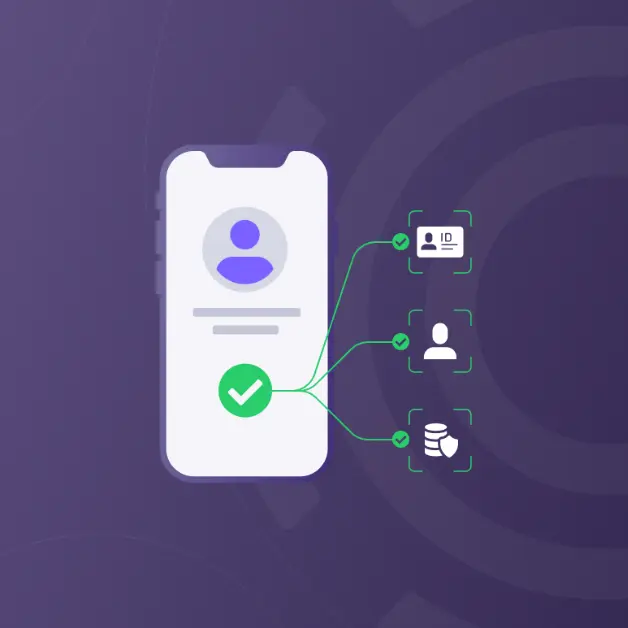

Best KYC Providers: The Guide to Automating KYC

This guide helps you choose the right KYC compliance software, highlighting why it’s crucial for fighting fraud in financial institutions. We break down the benefits of using automated KYC solutions and offer a straightforward list of the top providers to help you make a smart decision.

What KYB Means & Why It’s Important for Financial Institutions

This guide explains what Know Your Business (KYB) involves and its advantages. We discuss how KYB boosts operational efficiency, safeguards reputation, and enables access to global markets. Using real-life examples and simple advice, we aim to make KYB compliance easier for Financial Institutions.

The Banker’s Guide: Using AI for Fraud Detection

In this post we dive into the transformative role of AI in banking, highlighting its pivotal impact on enhancing fraud detection capabilities. By using advanced AI and machine learning technologies, banks can now proactively identify and mitigate fraud.

MANTL Adds Effectiv to its Fraud Prevention & KYC Offering for Deposit Origination

Effectiv, a leading real-time fraud and risk management platform, and MANTL, a leading provider of account origination solutions, today announced a strategic partnership to integrate Effectiv’s fraud prevention and KYC technology within the MANTL omnichannel account opening experience.

Treasury Prime Announces Partnership with Effectiv to Bring Fraud Detection to Enterprises and Banks

Customers can now leverage Effectiv’s Transaction Monitoring solution to detect fraudulent behaviors, reducing the risk of financial loss and reputational damage

Announcing Our New Funding Round & the Launch of Device Telemetrics & Intelligence Solution – DeviceIntel

The financial sector is witnessing an alarming surge in fraudulent incidents, creating a critical concern for the industry. In 2021 alone, fraud shot up by 70%, causing losses of over $5.8 billion. This troubling trend, paired with emerging threats like AI-based scams, makes it crucial to use the best tools available. In this post, we’ll take a closer look at how Seldon and Effectiv are teaming up to help financial institutions use artificial intelligence (AI) and machine learning (ML) to tackle fraud and risk.

Generative AI: How to Approach Risk Management In This New Era of Fraud

We are witnessing a significant surge in AI-enabled fraud and scams, and when coupled with both existing and newly surfaced data breaches, it poses a substantial new threat to the financial industry.

Unlocking the Power of AI in Financial Services: Fraud Prevention with Seldon & Effectiv

The financial sector is witnessing an alarming surge in fraudulent incidents, creating a critical concern for the industry. In 2021 alone, fraud shot up by 70%, causing losses of over $5.8 billion. This troubling trend, paired with emerging threats like AI-based scams, makes it crucial to use the best tools available. In this post, we’ll take a closer look at how Seldon and Effectiv are teaming up to help financial institutions use artificial intelligence (AI) and machine learning (ML) to tackle fraud and risk.